Over the past few weeks, the internet has been buzzing over the topic of Bitcoin Ordinals. The crypto community is losing its mind on the newfound application of the Bitcoin blockchain. With many major crypto projects like Crypto Punks, Onchain Monkey, Dego ds, and Bitcoin Frogs, shifting to Ordinals, a new culture of NFT is on the rise. However, many are opposed to the idea of allocating block space to seemingly “useless” JPEG files and are worried that this would threaten the overall ethos of Bitcoin. Given how the Ordinals work, their concerns are only justified. But this very mechanism is what builds up a true on-chain NFT/ digital asset.

How do NFTs work on Ethereum-like chains?

To understand what sets NFTs on Bitcoin apart from the ordinary NFTs on other layer1 chains, it is important to shed some light on how ordinary NFTs work. When we speak of NFTs, it is often the image file/metadata that we refer to. But contrary to that idea, NFTs actually have no images or, actual content associated with them. In fact, an NFT is simply a smart contract that obeys the ERC-721 token standard. The image/content comes from an optional extension to the ERC-721 specification to provide metadata. The token URI function takes in a token ID and returns a Uniform Resource Identifier (URI) — essentially a slightly generic URL – pointing to a JSON string that contains metadata such as the name, description, and finally an image/content for the individual token.

For storing the actual NFT content, whether it is an image, soundtrack, media, or text, there are two ways to go about it: on-chain and off-chain. On-chain storage is out of the radar because most NFT projects use JPEG files that are too large. It’s just not feasible. As a result, most projects opt to store the actual images off-chain. In that case, the NFT's smart contract contains information that points to some off-chain location where the actual NFT JPEG image is stored. The image and its metadata are stored in a hash that points to a decentralized hosting provider, usually the IPFS. Thus, by storing NFTs on IPFS, layer 1 chains prevent on-chain congestion and ensure scalability.

NFTs on Bitcoin

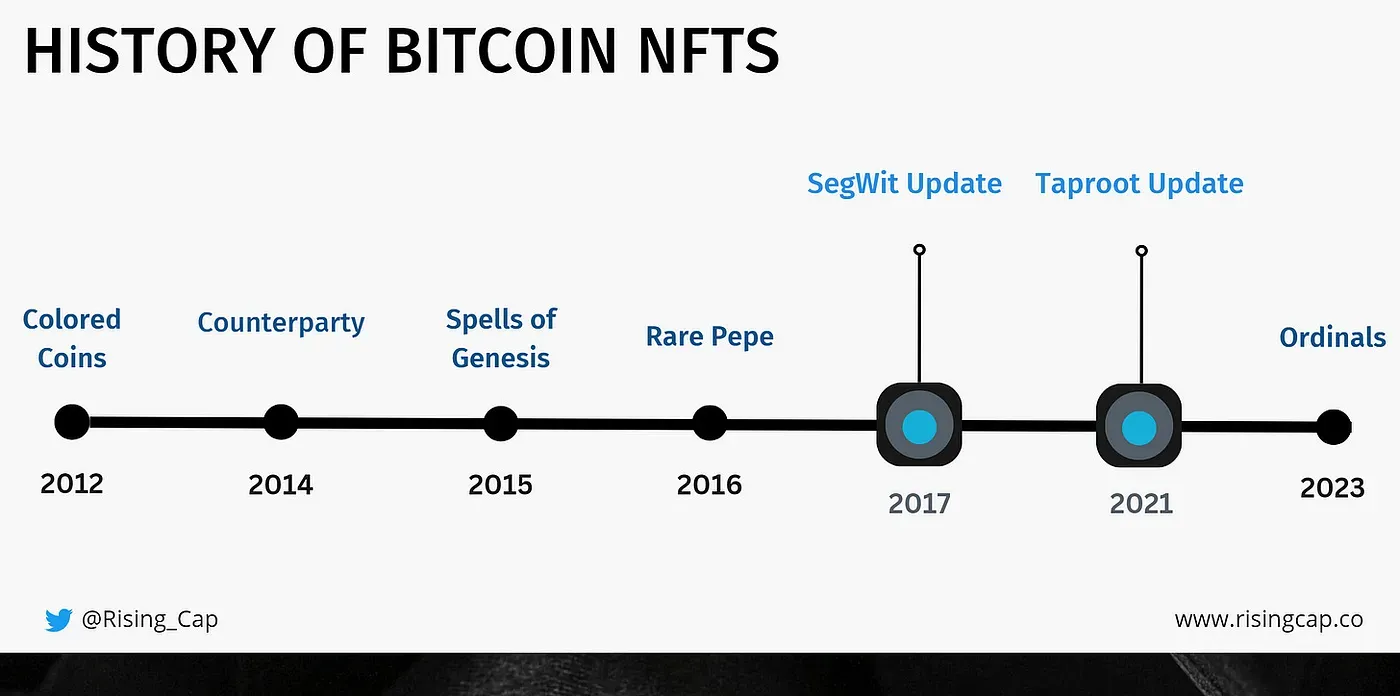

Looking back, the idea of digital assets on the Bitcoin blockchain has been there since 2014. While Bitcoin was home to the initial wave of NFTs like Rare Pepe, Spell of Genesis and colored coins, they failed to gain any significant traction at the time. NFTs on Bitcoin sidechains/Layer-2 solutions did not appeal to investors, simply due to the limitations of Bitcoin’s structure. In contrast, Ethereum and other layer 1 chains offered better scalability options. The perception that Bitcoin’s ultimate purpose is to act as a settlement for financial transactions also played its part in the whole situation.

The concept of ordinal NFTs was made possible through the development of ordinal theory and the implementation of two Bitcoin protocol updates: Segregated Witness (SegWit) in 2017 and Taproot in 2021. With the Taproot upgrade in 2021, Bitcoin tapped into a whole new era. The transaction throughput and block space-saving finally allowed large files like JPEG to be inscribed in blocks. Thus began the new era of Bitcoin NFTs

How do NFTs work in Bitcoin Blockchain?

In contrast to traditional NFTs, ordinal inscriptions are a new type of digital asset called Bitcoin NFTs (Non-Fungible Tokens). They are created by attaching data to individual satoshis on the Bitcoin blockchain and differ from traditional NFTs for being directly linked to the Bitcoin blockchain without any separate layers or protocols.

The SegWit, Taproot, and Ordinals updates, addressed the issues preventing NFTs to be stored in the Bitcoin network. Although the changes were just meant to increase the transaction capabilities of Bitcoin, they expanded the amount of arbitrary data that could be stored on the Bitcoin blockchain, allowing the inclusion of images, videos, and other media types in the blocks. Each Bitcoin contains 100,000,000 satoshis. These sats are numbered and assigned specific identities in the Bitcoin block by the Ordinals theory, allowing each sat— referred to as Ordinals — to be tracked and transferred. The Ordinals numbering follows the sequence they are mined in. They can further be engraved with content, such as images or video files, through a process called inscription, allowing those to act as NFTs.

To sum up, Bitcoin has gone through some changes allowing larger transaction formats and improved block space functionalities, which has now resulted in people inscribing JPEG images to blocks and assigning value to them. Since the original contents are inscribed on the main chain of Bitcoin instead of using a second layer or side chain or decentralized storage, Ordinals can be regarded as the only true on-chain NFTs in existence. With rare sats, things get more interesting. Assigning value to sats based on the timing of their mining is another trend that ordinals have brought to the table. The rarity of the events associated with the existence/mining of these rare sats makes them stand out from the regular sats. Although they do not have any significant function or, differentiating property, they are valued by the community, resulting in a whole new dynamic for NFTs.

Conclusion

The fact that Ordinals has made the existence of on-chain NFTs a reality, is not very appealing to many Bitcoin enthusiasts. This appeal majorly comes from the knowledge of it being the strongest chain to exist. In the Bitcoin chain, the security and authenticity of digital assets stay absolutely uncompromised. Although many are excited about the new progression of the Bitcoin blockchain, and it seems to be working in favour of the miners, there is another side who raised concerns about block space being wasted and the violation of Bitcoin ethos. The future of Bitcoin might meet unreasonably increased transaction fees as the whole purpose of conducting peer-to-peer transactions gets violated. While both sides have valid opinions, a lot of this is yet to be unravelled.