After the application of BlackRock for Bitcoin Spot ETF, major financial firms in the US followed the trend and filed to launch their own BTC Spot ETFs. Whether the SEC approves or not, this has surged the Bitcoin prices as the market relies on Blackrock's acceptance rate with the SEC.

Grayscale's victory in a lawsuit against the SEC's rejection of its Bitcoin Spot ETF is another event that severely spurred the ongoing flow. Adding on, Grayscale, now, has applied for an Ethereum Futures ETF, invoking comments from the Crypto community regarding its ambitious steps. With all these razzle-dazzles, both Bitcoin and Ethereum are expecting to see a bullish run ahead.

Why Do Crypto ETFs Matter?

Before jumping into the happenings, let's clear out what ETFs mean to the market. In novice terms, ETFs are baskets of assets containing a combination of stocks, bonds, or commodities– in a conventional scenario. They are particularly popular with investment institutions and financial advisors in the sense that they provide the opportunity to own an asset without exposing oneself directly to the risks associated. ETFs also make investment easier, enhancing the liquidity of the assets.

The types of ETFs subject to the discussion here are- spot ETFs and Futures ETFs. While Bitcoin Futures ETFs have already been approved by the SEC in 2021, Spot ETFs are still an area of sensitivity. BlackRock has already applied for its Bitcoin Spot ETF to SEC in June and still awaits a response. Following the largest fund management firm, Fidelity, ArcInvest, and, Invesco also applied for their own BTC Spot ETFs. The existence of such ETFs would open the door for Traditional Investors to invest in Bitcoin, ultimately spiking the price of the Bitcoin and related assets. Moreover, the previously tedious process of owning crypto will be mitigated along with the volatility and associated risks, encouraging industry adoption to the furthest extent.

Where We Are at Right Now

On 29th August 2023, The US Columbia District Court ruled in favour of Grayscale implying SEC to be wrong for rejecting its application for Bitcoin Spot ETF. But it does not warrant that the SEC will approve Grayscale's application for Spot ETFs. The only thing to be fixed from this ruling is that the SEC is to go through the application again.

After winning the case against the SEC, Grayscale filed an application for its Ethereum Futures ETF recently. This is the second time the firm is filing for an Ethereum Futures EFT, but under a different regulation than it did before. The current filing is made under the Securities Act of 1933.

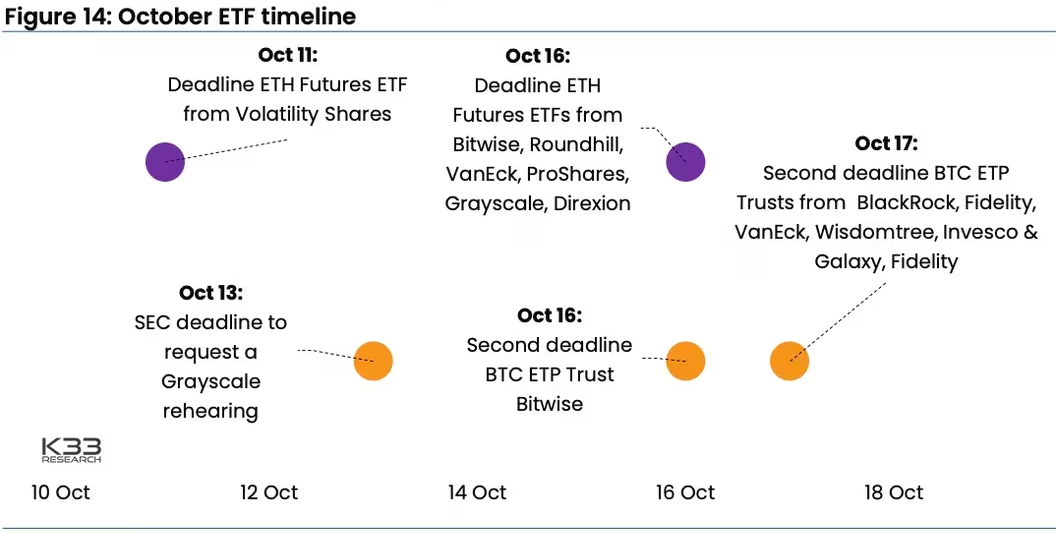

Looking back earlier, the world's largest financial firm, BlackRock, had also applied for Bitcoin Spot ETF this June. However, the SEC has decided to hold back their verdict until this October.

Although the recent events have encouraged other major financial firms to chime in and many major players like, Invesco, ArkInvest, Wisdom Tree BTC Trust, and Fidelity have applied for BTC Spot ETF, it cannot be guaranteed that the SEC will be compliant with Bitcoin Spot ETFs. Nonetheless, the decision about BlackRock's application is hoped to be declared by the SEC by the end of this year– ultimately settling the market's direction.

Is Bitcoin Spot ETF Finally Being Approved?

The current status of Bitcoin Spot ETFs has been the direct outcome of recent decisions and movements within the U.S. Securities and Exchange Commission (SEC). A notable development occurred when the U.S. District of Columbia Court of Appeals ruled against the SEC, deeming its rejection of Grayscale Investments' spot Bitcoin ETF application unjust. This landmark decision has reverberated throughout the cryptocurrency and asset management sectors, where there has long been a push for SEC approval of spot Bitcoin ETFs.

The SEC's concern has primarily revolved around potential market manipulation in spot Bitcoin ETFs, although it has granted approval to Bitcoin futures ETFs in the past. According to Grayscale's arguments, the surveillance mechanisms of Bitcoin futures ETFs and its proposed spot ETFs are closely correlated, considering the similarities between their underlying assets. The court's decision in favour of Grayscale has far-reaching implications, particularly for other firms such as BlackRock, Fidelity, and VanEck, all of whom have been eager to launch spot Bitcoin ETFs. While things might look favourable for BTC Spot ETFs, there's no reason to be blinded by hope, since the SEC is just obliged to review the application and not approve it.

Earlier, on the subject, BlackRock's application had garnered significant attention, as its approval could have potentially catalysed Bitcoin adoption. However, the SEC's recent delays in deciding on numerous Bitcoin ETF applications, including BlackRock's, underscore the ongoing uncertainty. With the next deadline for BlackRock's application set for October 17, the industry continues to watch for further developments from the SEC.

The Ethereum Futures ETF

Following its victory in the case against the SEC, Grayscale Investments has filed for an Ethereum futures exchange-traded fund (ETF), marking a significant move in the cryptocurrency space. This filing suggests that Grayscale is looking to expand its offerings beyond Bitcoin ETF, hinting at the potential inclusion of Ethereum spot ETF in the future. To add up, the SEC has just revealed that the regulator is already reviewing two Ethereum spot ETFs– spurring the hope of mainstream adoption of Ethereum. Ethereum ETFs would provide more direct exposure to the cryptocurrency and could pave the way for institutional adoption.

Following further into the Ethereum Futures ETF, the SEC has been inundated with more than 12 filings in the category since July. According to an Aug. 17 report from Bloomberg— the regulator does not look as though it will block the applications of nearly twelve companies, including ProShares, Volatility Shares, Bitwise and Roundhill, that have filed to launch Ether futures ETFs. Ethereum futures ETFs could follow the precedent set by Bitcoin futures ETFs, legitimizing the crypto market further. The cryptocurrency community awaits the SEC's decision on Grayscale's ETF filing.

Possible Impacts SEC Approval

The US Securities and Exchange Commission has received numerous proposals for crypto ETFs, which have attracted significant attention in the last few months. These ETFs, if approved, could have substantial impacts on the cryptocurrency market.

Spot Bitcoin ETFs, if approved, could encourage more investors to enter the crypto space, potentially boosting Bitcoin's price and liquidity. These ETFs are particularly appealing to retail investors and financial advisers, who overwhelmingly use or recommend ETFs for their clients. The availability of a spot Bitcoin ETF could lead to increased institutional interest and investment in the crypto market. Given its massive assets under management, BlackRock's plans to launch a Bitcoin ETF already provided a stamp of institutional approval. The approval of their ETF would make it easier for institutions to include Bitcoin in their portfolios, further legitimizing the asset. With several major firms vying for the approval of the SEC– even a small shift of their capital into a Bitcoin ETF could result in substantial investment in the cryptocurrency, potentially increasing its price stability and liquidity.

For Ether futures ETFs– it could have a similar impact on the Ethereum market as Bitcoin futures ETFs did for Bitcoin. Bitcoin reached its all-time high shortly after the launch of its first futures ETF in 2021. Although Ether's price has lagged behind Bitcoin in 2023, the introduction of Ethereum futures ETFs, along with significant technical upgrades, could potentially reverse this trend. This might reduce Bitcoin's dominance in the market, leading to better performance for a broader range of Ethereum-based tokens.

Conclusion

With all the crypto ETFs awaiting approval, the SEC is yet to come up with a decision. Despite the regulator being comfortable with Bitcoin Futures ETF, when it comes to spot ETFs, it is quite hesitant. Approval of these ETFs could bring massive changes in the market, as it will facilitate investors to own crypto without facing the direct risks and volatility associated with it.

In essence, the approval of these ETFs could pave the way for a more mature and dynamic cryptocurrency market, with the potential for substantial price movements, liquidity improvements, and a broader range of tokens flourishing. As the crypto industry continues to evolve, ETFs represent a critical step towards its wider adoption and integration into mainstream finance.