2023 has brought quite few unique surprises to the Bitcoin blockchain. Earlier this year, we witnessed the rise of Bitcoin NFTs. It seems that the introduction of Ordinal Inscriptions has paved the way for further experimentation on the Bitcoin blockchain. In fact, the term ‘experiment’ was used by the BRC-20 token creator (@domodata on Twitter) himself:

gm. I'm glad that some people like the experiment. Some additional notes.

— domo (@domodata) March 9, 2023

1. These will be worthless. Please do not waste money mass minting.

2. Due to how some inscription tools are set up, the 'balance' may be minted to the intermediary address used in https://t.co/mja39YGIow…

Despite being a fun experiment, there are currently 14,300 BRC-20 tokens created, boasting a total market cap of 777 million USD at the time of writing.

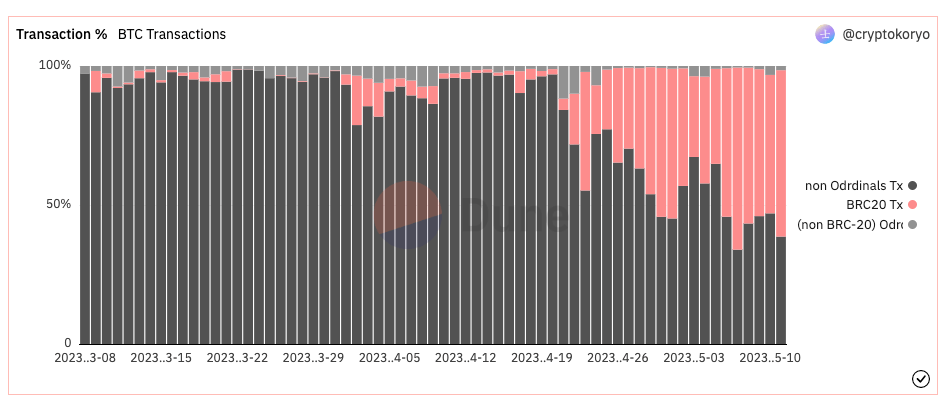

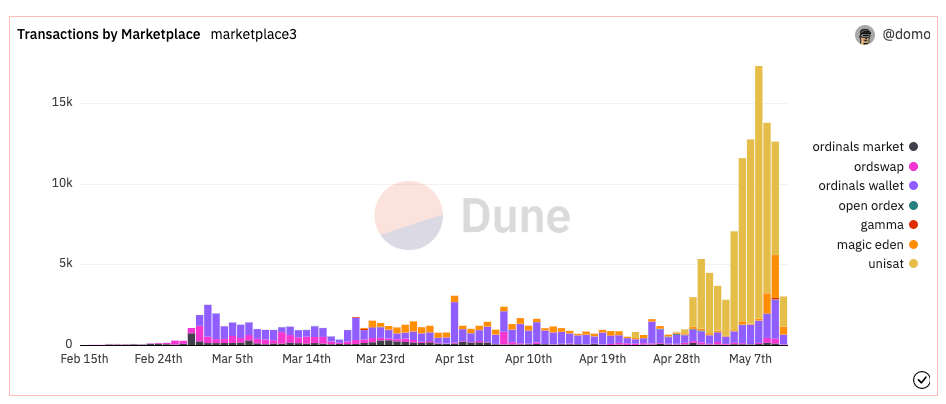

While some individuals are reaping profits from minting BRC-20 tokens early, others are less happy, as the emergence of these tokens has led to significant congestion on the blockchain. The congestion was so severe that Binance had to pause BTC transfers due to a large number of pending transactions:

JUST IN: Binance temporarily suspends all #Bitcoin withdrawals, citing "network congestion issues."

— Watcher.Guru (@WatcherGuru) May 7, 2023

Setting aside those concerns for now, let's first examine what BRC-20 is. The rapidly evolving landscape of BRC-20 tokens and Ordinals presents both opportunities and challenges. Staying well-informed will be crucial for navigating this emerging trend.

What Should You Know About BRC-20?

To understand BRC-20, it's important to grasp how Ordinals NFTs work on Bitcoin network. If you're unfamiliar with the concept, feel free to explore this article that delves deeper into Ordinal Inscriptions.

In essence, BRC-20 is a JSON text inscribed within an Ordinal. The text outlines a few straightforward variables and functions:

- The ticker which can be claimed by the first person to deploy it

- Max supply

- Token limit per mint

- Deploying, minting, and transferring functions

The BRC-20 tokens can be seen as a hybrid between NFTs and meme tokens, with more focus on community and ideology rather than specific utility. While bitcoin network token standard sounds simalar to ERC-20 which is a widely used token standard on Ethereum, both standards have little in common. An ERC-20 is a smart contract that establishes a set of rules for creating and managing tokens. BRC-20, on the other hand, is not fundamentally different from Ordinals, except that it can have a larger supply. Because BRC-20 lacks smart contract functionality, the tokens are much less flexible than ERC-20 tokens, and can't offer meaningful use-cases. On the upside, this also means there is no risk of developers "rugging" or manipulating a project by altering functions, as can occur with Ethereum smart contracts. Such issues are impossible with BRC-20 tokens.

How To Buy a BRC-20 Token?

In the early days, purchasing Ordinals NFTs was a challenging process because the infrastructure and dApps for doing so had not yet been developed. However, developers have since managed to create a reasonably user-friendly experience for Bitcoin tokens.

The go-to solution is the UniSat Wallet, which is similar to well-known crypto wallets like MetaMask. To use it, you'll need to create a password and securely store the provided seed phrase. Additionally, you'll need some BTC for gas fees in order to perform any actions within the wallet.

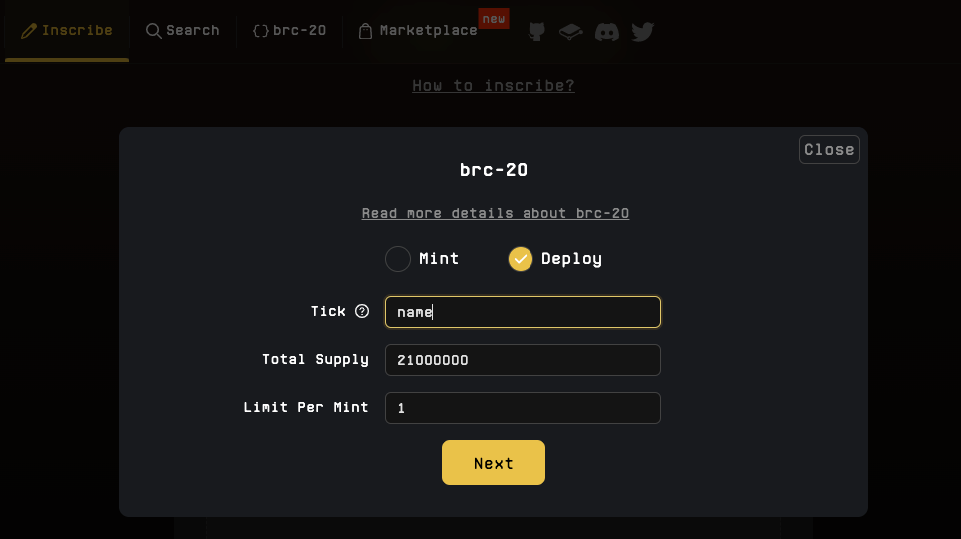

Creating your token is as easy as visiting UniSat, selecting "Inscribe," and then choosing "BRC-20." Then:

• Select Deploy

• Enter Tick Name (max 4 unique words )

• Enter Total Supply & Limit per Mint

• Click on Next ( x2)

• Click on Sumbit & Pay

• Pay with UniSat Wallet

Congratulations! Your token is now forever on Bitcoin blockchain.

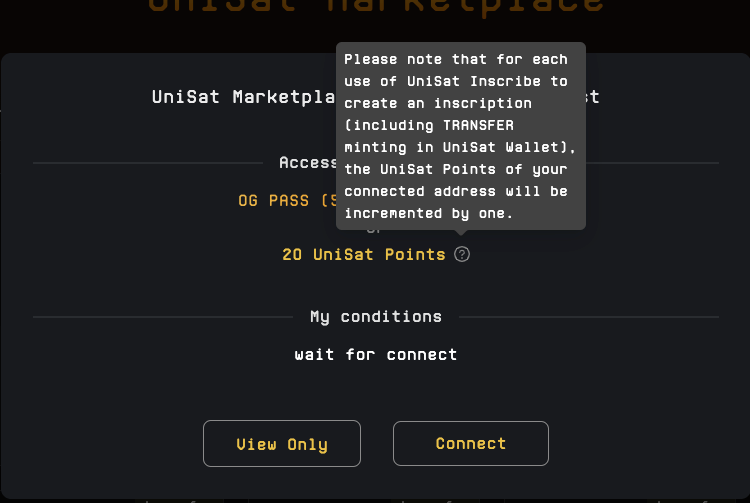

Buying or selling is also relatively straightforward. You can do this on the UniSat marketplace. The key difference from other more familiar crypto marketplaces is that you must have 20 Unisat Points to access the marketplace, although a view-only mode is available for browsing Bitcoin tokens. To earn these UniSat Points, you need to participate in platform activities.

As mentioned earlier, the emergence of BRC-20 tokens has caused significant upheaval in the crypto space, with Bitcoin enthusiasts dividing into two camps. One group supports Ordinals and BRC-20 tokens, while the other prefers the Bitcoin network to remain a store of value, as it was before.

The Battle for Bitcoin's Future

While the current utility of these tokens primarily revolves around representing the value of their associated communities, BRC-20 supporters argue that there's potential for future utility and growth as the ecosystem evolves.

At this point, there are no smart contracts on the Bitcoin blockchain, which means there's limited utility. The only function possible on Bitcoin is value transfer – you can buy a token and exchange it for something else.

However, this could change, and it might even be possible to connect BRC-20 tokens to Ethereum, unlocking DeFi possibilities. Jack Levin, founder of the Fair Crypto Foundation, recently launched a BRC-20 token VMPX that is currently a meme token but comes with the promise of future utility. Jack Levin and his team are already working on it. The solution would involve a roll-up, allowing the use of original BRC-20 tokens within a smart contract-supporting ecosystem, with Bitcoin serving as a settlement layer.

Other BRC-20 supporters also argue that Layer 2 solutions on Bitcoin are inevitable, and the current situation, despite presenting challenges, serves as a stress test that's beneficial for scaling and preparing for future challenges when Bitcoin and crypto move beyond web3 enthusiasts bubble towards mass adoption.

On the other side, Bitcoin maxis prefer Bitcoin to remain solely as a digital store of value solution. They argue that BRC-20 tokens carry significant risks, as most tokens are designed to make their creators rich and carries a lot of risk to investors. Moreover, this diverts capital that would otherwise remain within Bitcoin itself. The most obvious argument against BRC-20 tokens is, of course, network congestion and the high gas fees required for transactions to go through.

The issue has become so severe that Bitcoin core developers are taking action against BRC-20 tokens and Ordinals:

bitcoin-core devs want to kill ordinals & BRC-20s

— Ryan Berckmans ryanb.eth🦇🔊 (@ryanberckmans) May 9, 2023

Miners likely want to double down on ordinals & BRC-20s to increase fees and the value of private mempools

Ordinals & BRC-20 holders want the right to exist and pursue growth

Civil war https://t.co/QeoAHJpPN4

So what exactly happened? A developer using the pseudonym "Supertestnet" initiated a transaction with no input or output, which led to the transaction being considered a bug. Fixing the bug by making the Ordinals protocol ignore the inscription would change inscription numbers.

According to Danny Diekroeger, founder of Bitcoin Lightning platform Deezy, the bug doesn't pose any risk to the Ordinals protocol itself. He pointed out that he believes inscription numbers were already broken early on anyway.

At this point, there's no immediate danger to the protocol, although the long-term consequences remain uncertain. In the short term, those running indexing software needed to address the bug.

Is It Worth Following the Evolution of BRC-20 Tokens?

The emergence of BRC-20 tokens on the Bitcoin blockchain has sparked both excitement and controversy within the crypto community. As the Bitcoin ecosystem continues to evolve, the long-term implications of BRC-20 tokens and their place within the broader crypto landscape remain uncertain. However, one thing is clear: staying informed and adapting to these emerging trends will be essential for anyone looking to navigate the ever-changing world of cryptocurrency.