Crypto in 2023: Bull Market ahead?

The recent surges in BTC price, altcoins growth after XRP's win against SEC, and crypto making its way to the mainstream platforms and traders have got the whole community on its toes for the next Bull market.

So far, the year has been full of rollercoaster rides for crypto. Fortunately, the ups have surpassed the downs. With the series of events starting from XRP’s win against the SEC to Google Play opening its gate to cryptocurrencies, the community believes a bullish time to be waiting ahead.

Here are the notable events that have been ringing all the bells:

- XRP’s comeback after the win against SEC: the buzz rippled down to Coinbase and Binance

- Bitcoin’s price hitting a yearly high of $31k instilled an optimistic attitude in the BTC community

- Google Play announces a policy change allowing NFTs in their apps

- Jacobi’s Bitcoin ETF to be launched as Europe’s first

Bitcoin price hits a new height

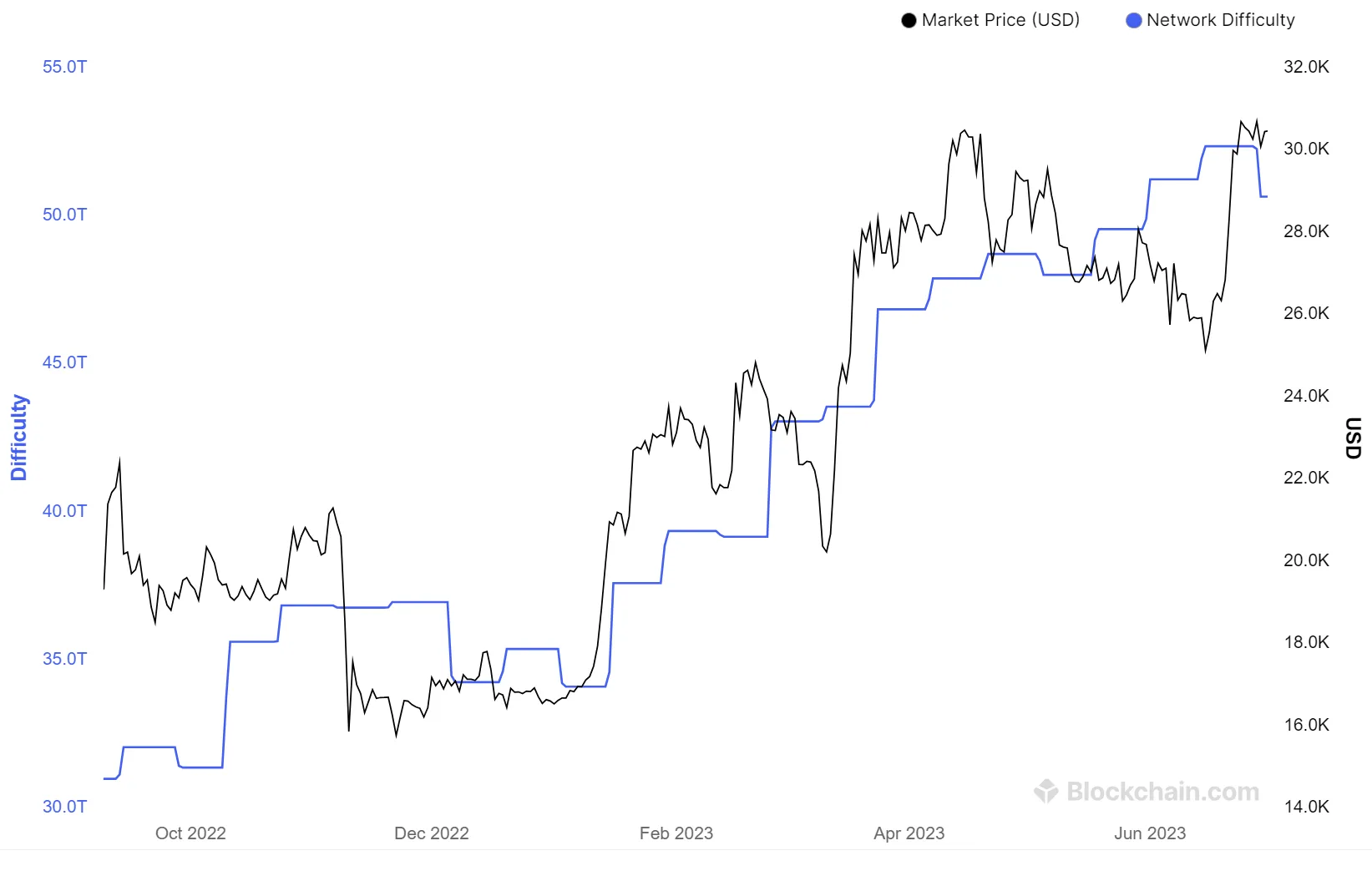

2022 has been a gloomy year for most of the crypto. With the Terra Luna crash and FTX fallout, the crypto-verse had a hard time keeping their prices up. Almost every currency, BTC included took the hit. But for this year, Bitcoin seems to be moving faster towards a bull market. The prices hit $31k last week and the mining activities are a testament to the rising hope in miners.

The rising hash rates and mining activities in the chain have led many to conclude that miners are definitely bullish on the market. The increased mining activities and difficulties are often stemmed from miners’ confidence in the network, higher possibility of profitability, and increased network health. The previous data also indicates a correlation between mining difficulty and coin prices. Hence, it is safe to conclude that the current mining trend is indicating a bull market.

According to the experts – if Bitcoin can hold up its value to $31k, the prices should be exactly doubled by the end of the year. Yet, with the current price, there’s a long way ahead to reach the previous all-time high of $ 69k.

Before this, the crypto giant had been trading at its three-month low with a level below $26,000 when SEC sued Binance over mishandling customer funds and breaking security laws. But the scene seems to have recovered after the recent win of XRP over SEC on a similar case it had been fighting since December 2020.

XRP not a security?

The whole Ripple versus SEC legal scenario started when SEC filed a lawsuit against Ripple claiming that the XRP tokens being exchanged on the platform were securities. This was in December 2020. After years of being strangled by the accusations, XRP has finally broken free. The results were not just limited to XRP but uplifted the whole crypto market.

If you have been catching up with the market movements, the XRP case would sound familiar to you. SEC pulled up some similar moves against Coinbase and Binance claiming a few of their altcoins to be securities, including Solana and Cardano. The values plummeted and marketplaces delisted those tokens. But right after the judge declares XRP not to be a security, the prices rise up.

Some key points in the crypto market following XRP’s win, over the period of 24 hours:

- Led the crypto market with a 66.4% gain, followed by XLM's 54.2% rise.

- Positive sentiment pushed Bitcoin to a new yearly high of $ 31k

- Ethereum surpassed $2,000.

- SOL, ADA, and MATIC rebounded after SEC-related declines in June at 34.7%, 23.7%, and at 19.6% respectively.

- Lido DAO surged 25.3%, benefiting from the overall market optimism.

- PepeCoin led meme coins with a 17.3% rise.

- DOGE and SHIB also experienced gains of 8.9% and 6% respectively.

NFTs on Android?

Google has always been in the grey zone with cryptocurrencies and NFTs. It has never said a clear no, but there wasn’t any collaborative or, welcoming response from their side either. That being said, Google assured that they would be making some policy changes relating to NFTs, earlier this year. In the 12th of July, they finally cleared out their policies and regulations that would allow developers to add NFTs in their games.

To explain the policies in monkey terms, developers are required to be transparent to the users and declare whether their games are blockchain-based or not. If it has NFTs, they are to clarify that too. But betting or winning real money with NFTs is a no-go– according to the policies Play Store had for games involving gambling. According to the tech giant, they will be designed to make the games more fun or helpful.

While there might not be any direct immediate impact on the crypto market for Google’s policy shifts, the event still bears great significance for improving the opinions on crypto in public spheres. This could also act as a green signal for many companies and invoke them in opening up to the crypto market. The only confirmed favor that Google’s acceptance adds is that it validates NFTs and cryptocurrencies. On a larger picture, the whole event confirms the future significance of crypto in mainstream platforms.

Europe’s First Bitcoin ETF

When it comes to crypto adaptability, Europe has been a step ahead of the United States. The region’s first spot Bitcoin Exchange-Traded Fund (ETF) by Jacobi Asset Management was set to launch in July 2022. But the market conditions followed by Terra Luna's collapse and FTX crash put it to a halt. However, the company has recently confirmed the previously postponed launch to take place this month.

The ETF, unlike the existing ETN trading platforms, will provide investors with regulated exposure to Bitcoin’s price movements. The platform will be more suited to attract traditional investors in crypto.

But why now?

Jacobi Asset Management disclosed to Financial Times that the delay in their launch was in response to 2022’s unsettling market conditions. So, the timing of its launch, now, may indicate an improvement in the market conditions. There’s also a possibility that the company acknowledges the shift in market demand by making its move now.

Besides Europe, a significant amount of fund managers in the US have been shooting for a spot as Bitcoin ETF.

Conclusion

The whole crypto market had always been a very dynamic and highly volatile genre. As far as the recent trail of events follows, it surely has been breaking out from the crypto-winter. Investors are optimistic about the market after Bitcoin’s price spike and Jacobi’s launch of BTC ETFs. With Google accepting NFTs and XRP coming back to the market, the community has tailored a bullish vibe.