Ethereum 2.0 is a new version of the Ethereum blockchain that will use a proof of stake consensus mechanism to verify transactions via staking. It will replace the proof of work model and reduce the amount of electricity needed for the execution. Why is this important and should investors pay attention? Read more below!

Constant delays of operations - why?

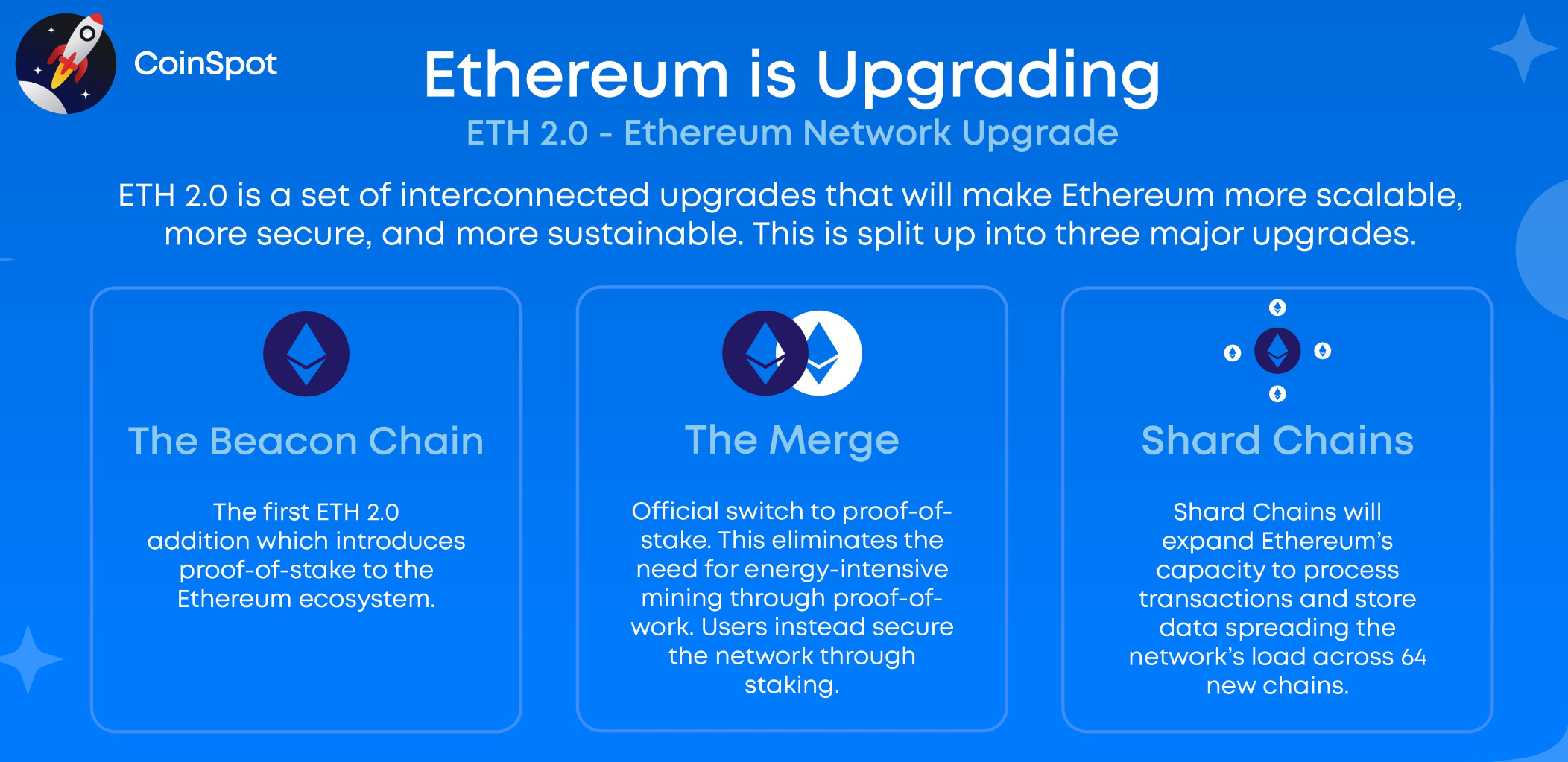

Under the original roadmap, things were being worked on in the background using a separate network to the prominent one people were/are using, and the main one would be merged with this new network once everything was up and running. This included PoS (more efficient network), data sharding (more scalable data storage for the network) and execution sharding (more scalable transaction processing for the network).

That original roadmap was scrapped in late 2020 and replaced with a new roadmap. It was L2-centric, which entailed scrapping execution sharding and settling for only data sharding in the long term, with the option to reevaluate execution sharding at a later date and focus on the transition to PoS in the short term. Under this new L2-centric roadmap, the main network would be merged with the new network as soon as possible, and L2s would be supercharged by sharding.

This new L2-centric roadmap was then iterated upon to end up where it is now. Execution sharding has been abandoned for the foreseeable future, data sharding has been fleshed out more, statelessness and state/history expiry have become part of the roadmap to make the L1 network more lightweight, and more. Everything will happen in incremental steps, rather than as just one significant upgrade like the original roadmap would have brought.

The "Ethereum 2.0" terminology originated from the initial roadmap, as it was an Ethereum 2.0. Everything would still exist under the original Ethereum, but all the improvements would come as one massive upgrade. People stuck to this idea, and as the roadmap updated to become more incremental, this idea gradually became more and more incorrect, leading to people being confused over what would be coming.

What is this “merge” thingy?

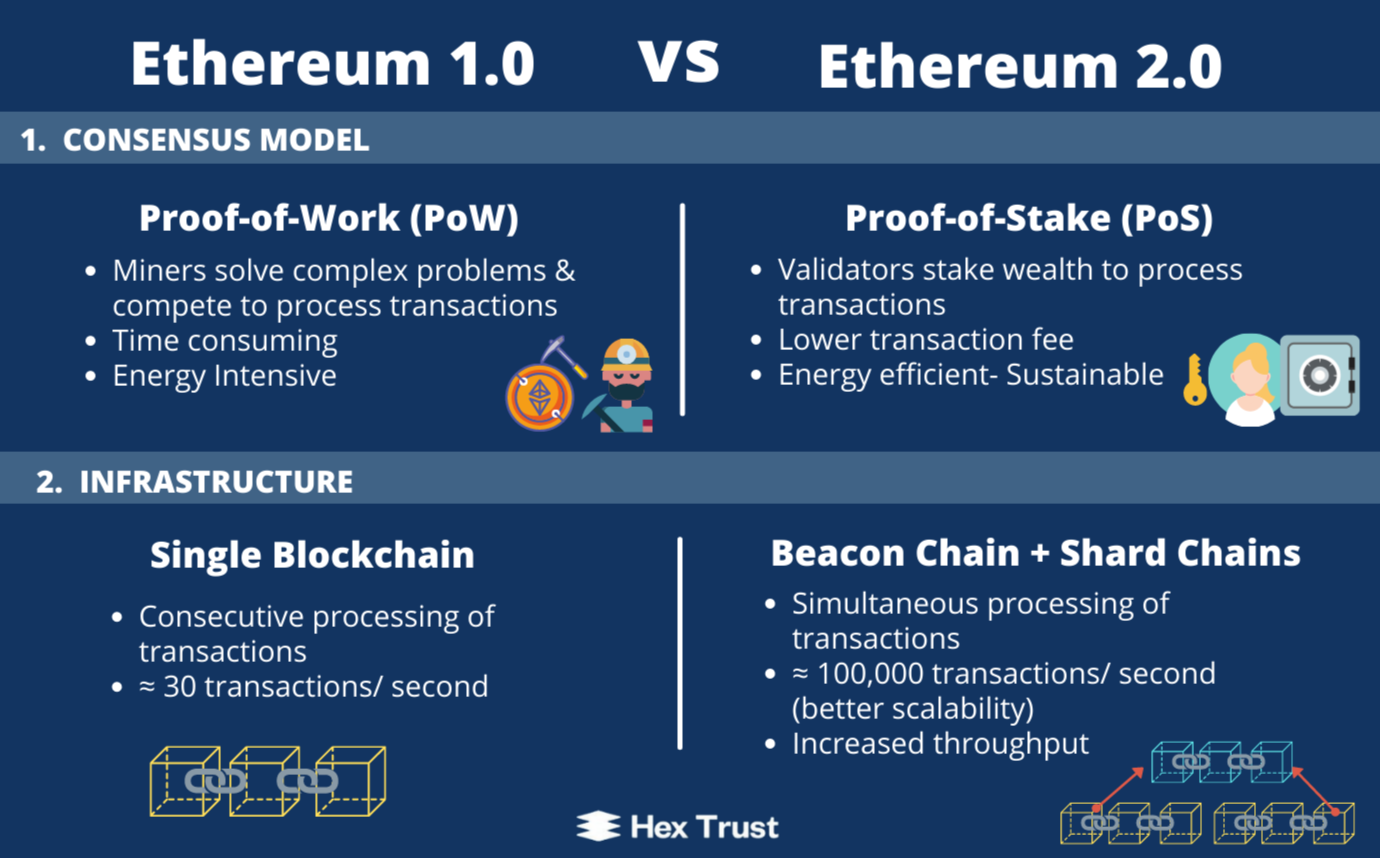

First of all, Ethereum will be secured by Proof of Stake when the merge happens instead of Proof of Work. Additionally, the merge is not "ETH 2.0"; there is no ETH 2.0. It's an obsolete term. For people that look at buying and not sure what to do - if you currently hold ETH, you don't need to do anything. You will still hold the same amount of ETH after the merge, and there is no "ETH2 coin", no need to migrate anything, etc. Everything comes precisely the same; only the consensus mechanism changes under the hood.

It's called "merge" because it's about merging the Beacon Chain (consensus layer) with the current chain (execution layer) and ditching the proof of work part of the execution layer.

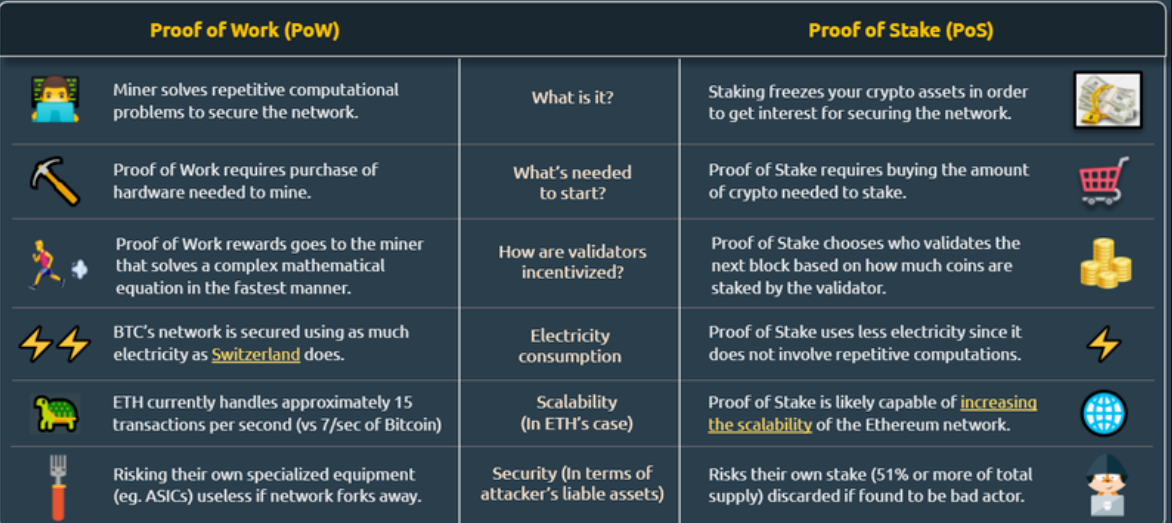

Both PoW and PoS achieve consensus by different means. For example PoW basically says it costs too much to mess up with the order of blocks; playing by the rules is more lucrative. While PoS says it costs too much to mess up with the order of blocks because if I do, I'll lose all the money I put up as collateral. Since it's only the consensus mechanism changing, Proof of Stake by itself will not lower gas fees significantly.

Why should ETH even merge?

To begin with, it opens the door for many scaling solutions in the future, namely data sharding, statelessness, and light clients. It helps reduce some complexity of the code going forward by separating concerns between execution and consensus. Appeasing the environment and gamers is a nice side-effect but not a significant reason behind the switch to PoS since it's mostly about externalities over which Ethereum as a protocol doesn't have much control (source of energy production, GPU supply chains, etc.)

It is also important to mention that for PoW you need miners to be able to cover at least all the hardware and energy they use; otherwise, no one will mine. This requires an enormous issuance quickly sold for fiat to pay the bills. Meanwhile, for PoS you just need to give some yield to stakers to make people want to deposit capital rather than just invest it elsewhere. No big bills to pay beyond an ordinary computer and an internet connection, so the yield just has to reflect the opportunity costs and risks involved.

Why hasn’t this been done in the past to start with?

Proof of Work is easy to conceptualize and implement. Proof of Stake isn't. Especially in 2014, it was mostly a theoretical concept still being researched, with some blockchains implementing some versions.

Several fundamental problems with PoS needed to be overcome from a research perspective before considering implementing it. There is no one-size-fits-all Proof of Stake. Every PoS blockchain comes with its own PoS specification with pros and cons on various aspects, so it's not as simple as "but this other blockchain did it; why can't Ethereum just do the same thing.

Starting as a proof of work chain had the benefit of letting anyone mine coins on their own without anyone's permission. That helped the coin distribution become way better than those newer chains that are proof of stake from the start and have to decide how to allocate the initial coins, which can't be done permissionless.

What will the process look like?

Phase 0: This is the introduction of Proof of Stake and the creation of the ETH 2.0 blockchain. This is the backbone of the ETH 2.0 system. Imagine it like the foundation upon which the 64 lane road is being built. It is a wide flat foundation of rock and it is not connected to the existing Ethereum 1 road. While there are no cars driving on this chain yet (there are no transactions on this chain), people are able to move from the Ethereum 1 road and onto this new road. The people moving over are security guards making sure that the foundation of the road remains secure and ready for upgrading once the developers are ready to build out the rest of the road.

This is what the deposit contract and staking talk right now is about, you can move your 32 ETH in the deposit contract which will move your 32 ETH to the foundation of the ETH 2.0 road (known as the beacon chain) where you can stake your ETH and keep the road secure and ready for a future upgrade. In return these people get paid out a variable % interest on their 32 ETH for their service.

Phase 1 will implement new architecture for how the Beachon Chain stores data, called sharding. Currently, Ethereum full nodes must store a full history of every transaction that’s ever occurred and process every new transaction on the network. This makes running a full node onerous and is a primary source of Ethereum’s scaling woes. Sharding will subdivide Ethereum’s Beacon Chain into 64 pieces, or “shards”. Where nodes currently store data for the entire blockchain, each shard will have its own subset of nodes processing it. Sharding alone will scale Ethereum’s throughput by 64x. Even when sharding is implemented (possibly around this time next year), the entire Ethereum ecosystem will continue to run in parallel on the proof of work chain.

Once Ethereum’s Beacon Chain has a full set of PoS validators securing the network, and the chain has been subdivided into 64 parallel shards, then it will be time to merge Ethereum as we know it today into Ethereum 2.0. This will be accomplished by merging all of the smart contracts and transaction data from the PoW chain into a shard under the PoS chain. At this point, Ethereum will have successfully transitioned from proof of work to proof of stake.

When the merge between Eth1 & Eth2 takes place, all of the smart contracting execution will take place within a single shard on Eth2. The final phase of Ethereum 2.0, Phase 2, involves unlocking smart contract execution across some or all the Beacon Chain’s 64 shards. Additionally, phase 2 may introduce a new virtual machine.

Conclusion

Ethereum 2.0 will move Ethereum from proof of work to proof of stake. In a nutshell, proof of work is a system where people have to essentially waste electricity, proving they have done work and put effort/money into securing the blockchain.

This makes it hard for one person to overtake the network because it would be extremely expensive to burn all that power. Proof of stake requires people who secure the network or "validators" to put up ETH as collateral as a "stake" in the network.

In addition to this, our team firmly believes that Ethereum will receive an additional increase in price, as the burning numbers still continue increasing, and cryptocurrencies are only getting started!