The long-awaited approval of a Bitcoin ETF in late 2021 sent shockwaves through the traditional finance (TradFi) and cryptocurrency worlds.

Now, with the recent arrival of the Ethereum ETF, the question on everyone's lips is: What does this mean for the future of cryptocurrencies?

This article takes a look at the potential impact of the Ethereum ETF, analyzing its implications for Ethereum itself, the broader crypto market, and potential future inclusions.

Understanding ETH's ETF and its significance

An Ethereum ETF (Exchange-Traded Fund) is a financial product that allows investors to gain exposure to the price movements of Ethereum without owning the actual cryptocurrency. It operates similarly to a traditional stock ETF, where shares are traded on stock exchanges.

The significance of an ETH ETF lies in its potential to attract institutional and retail investors who may be interested in investing in Ethereum but prefer the convenience and regulatory oversight provided by traditional financial markets. By offering a regulated and accessible investment vehicle, the ETH ETF can potentially increase the liquidity and trading volume of Ethereum, leading to greater price stability and market efficiency.

Moreover, the ETH ETF can also serve as a benchmark for the overall performance of the cryptocurrency market, providing valuable insights and data for investors and analysts.

Overall, ETH's ETF has the potential to bring more mainstream attention and adoption to Ethereum, further solidifying its position as a leading cryptocurrency in the market.

Comparing ETH's ETF with Bitcoin's ETF

While both ETH ETF and Bitcoin's ETF aim to provide investors with exposure to the price movements of their respective cryptocurrencies, there are some key differences between the two.

Firstly, Ethereum has a different underlying technology compared to Bitcoin. Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps), while Bitcoin primarily serves as a digital currency and store of value. This fundamental difference in functionality may attract different types of investors to each ETF.

Secondly, Ethereum has a larger and more active developer community compared to Bitcoin. This vibrant ecosystem of developers and projects contributes to the continuous innovation and growth of the Ethereum platform. As a result, this ETH ETF may offer investors exposure to not only the price of Ethereum but also the potential future developments and applications built on the Ethereum network.

Lastly, regulatory approval processes may differ between the two ETFs depending on the jurisdiction. It is important to note that while Bitcoin's ETFs have already been approved in some countries, ETH's ETF may face its own set of regulatory challenges and approval processes.

Potential impact on Ethereum's price and market capitalization

The ETH ETF could have a significant impact on Ethereum's price and market capitalization.

Here are some potential consequences of the Ethereum ETF:

- Increased Institutional Investment: Similar to Bitcoin, the Ethereum ETF offers institutions a regulated and familiar way to gain exposure to Ethereum. This could lead to a significant influx of institutional capital, potentially driving up the price of Ethereum and fostering ecosystem growth.

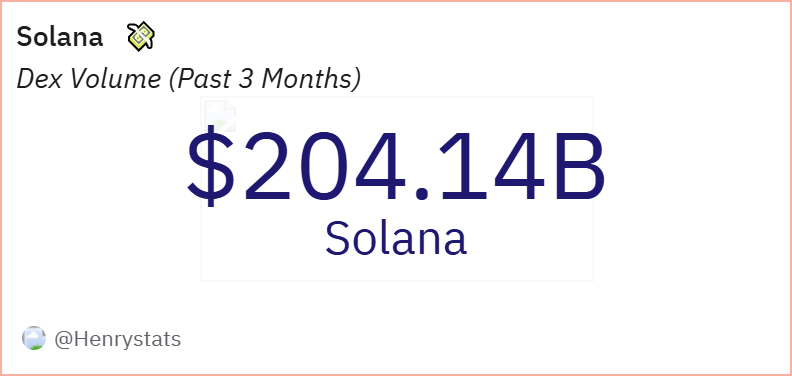

- Enhanced Market Liquidity: The ETF could increase the overall liquidity of the Ethereum market, making it easier for investors to buy and sell Ethereum without significant price fluctuations. This improved liquidity could attract more investors and developers to the Ethereum ecosystem.

- Validation of Ethereum Technology: The approval of the Ethereum ETF signals a growing recognition of Ethereum's technology and its potential applications beyond just cryptocurrency. This validation could also boost developer and user confidence in the Ethereum ecosystem.

- Potential for DeFi Growth: As Ethereum remains the dominant platform for decentralized finance (DeFi), increased investment through the ETF could fuel further innovation and adoption of DeFi applications. This could lead to a more vibrant DeFi ecosystem.

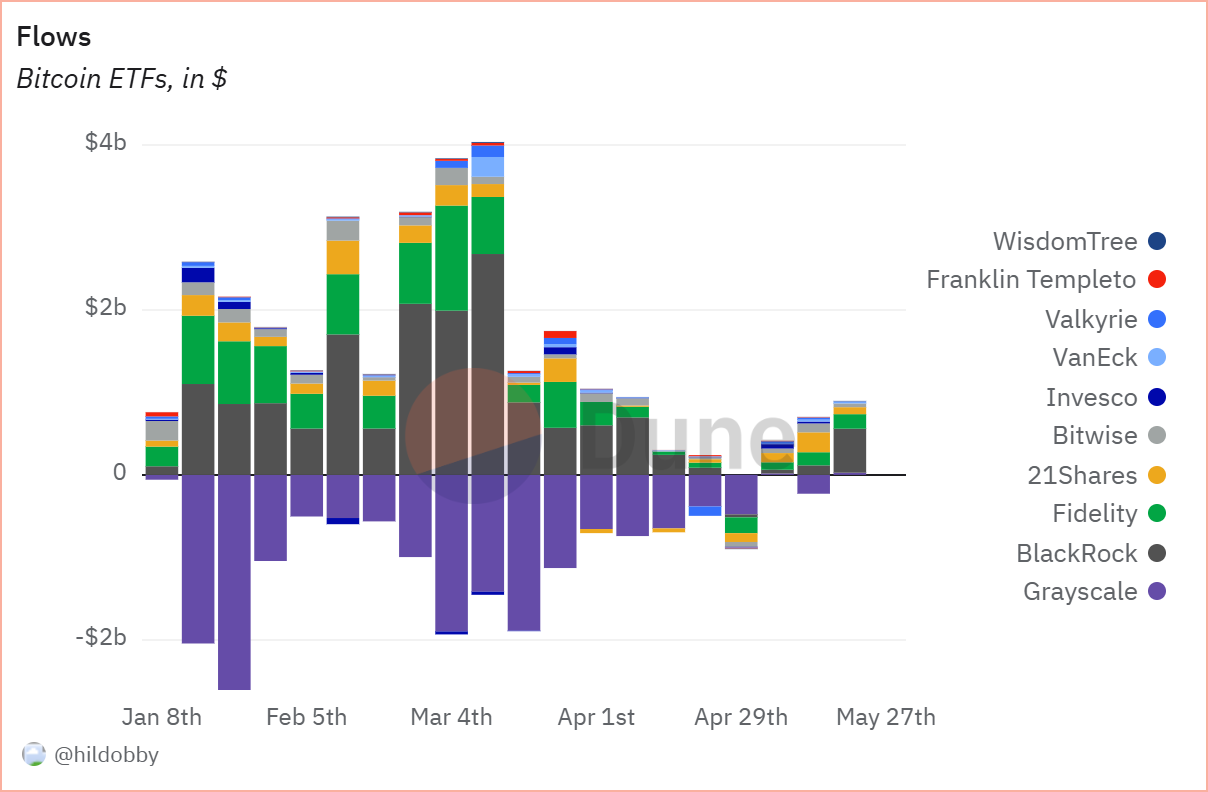

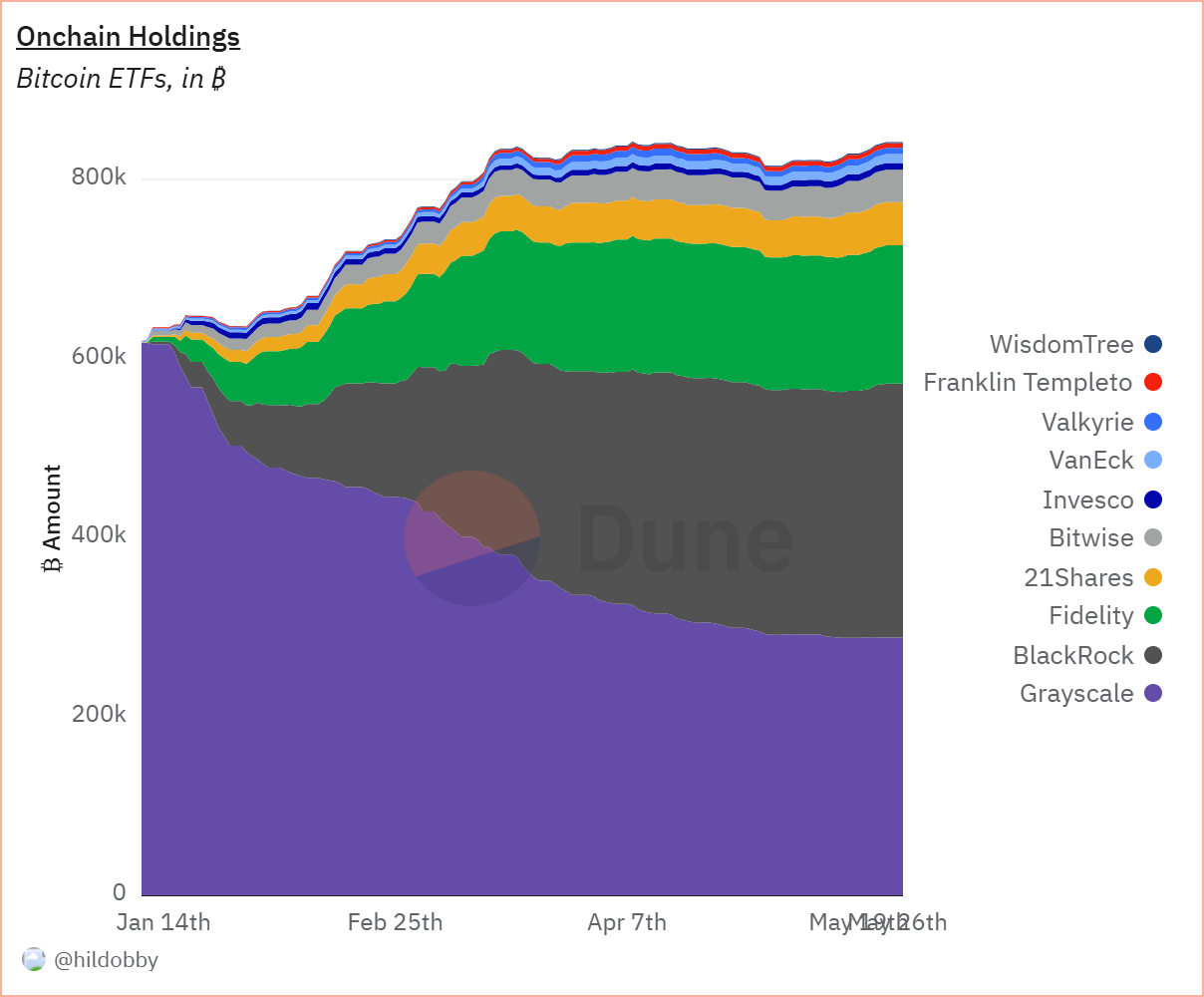

However, it's important to acknowledge that the Ethereum ETF' impact might not be as dramatic as the Bitcoin ETF's. Here's why:

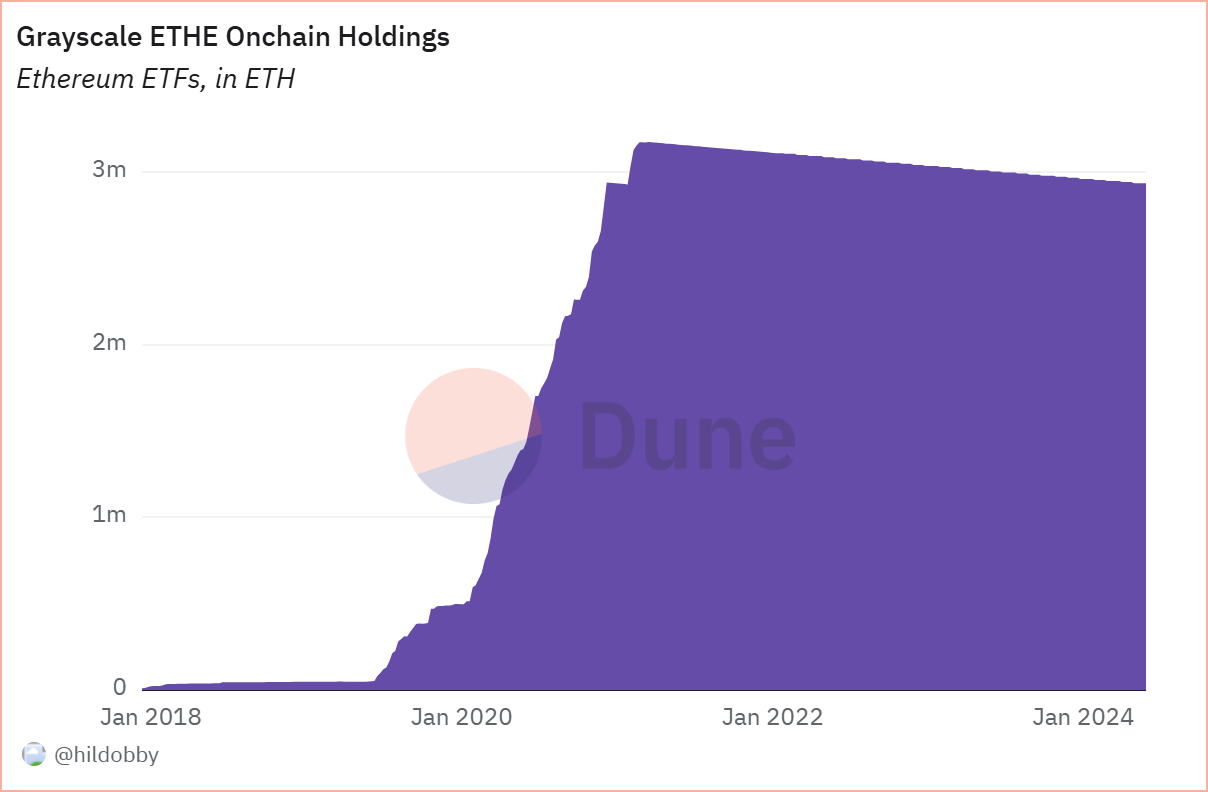

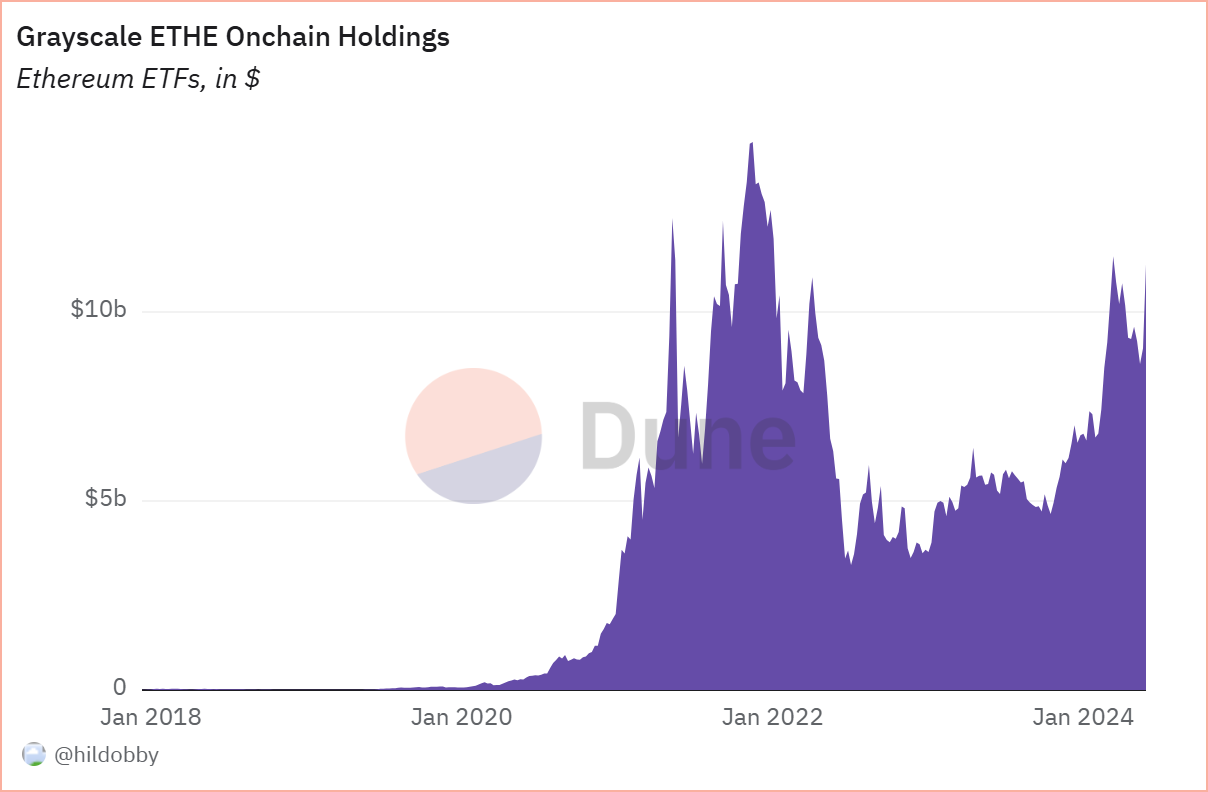

- Existing Investment Options: Several established investment vehicles already offer exposure to Ethereum, such as Grayscale Ethereum Trust (ETHE). This could dampen the novelty factor associated with the ETF.

- Regulatory Uncertainty: Regulations surrounding cryptocurrencies remains fluid. Unforeseen regulations could still stall the growth of the Ethereum ETF and the broader crypto market.

Potential Candidates for Future ETFs

With both Bitcoin and Ethereum ETFs now a reality, speculation naturally turns to potential future additions. Here are some cryptocurrencies that might be considered for ETFs in the coming years:

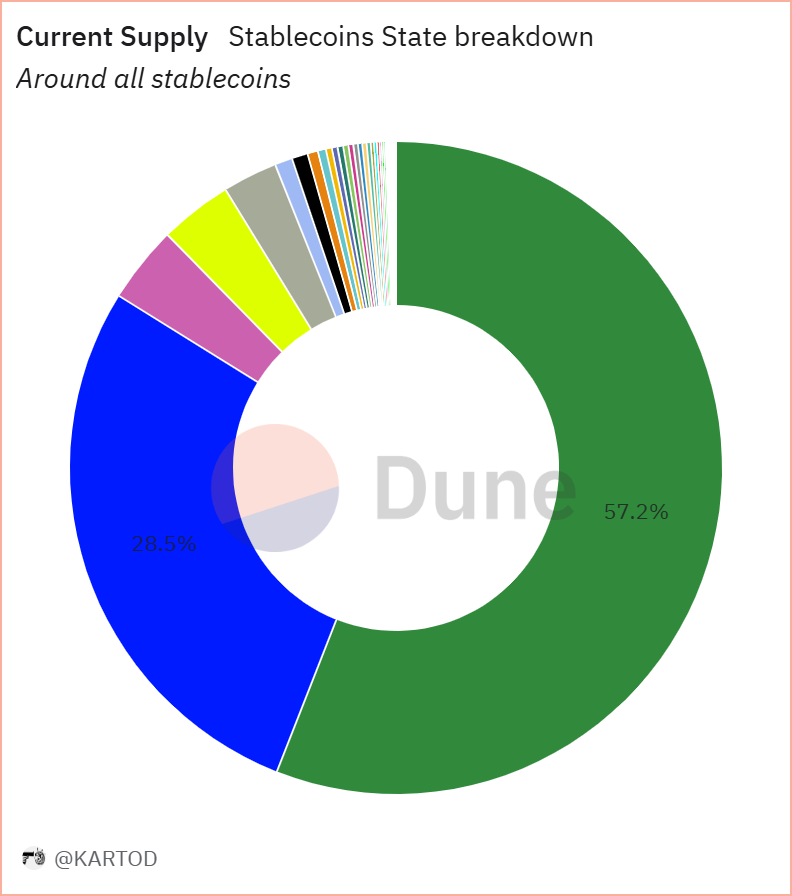

- Stablecoins: Given their price stability and potential use cases in TradFi, stablecoins like USD Coin (USDC) or Tether (USDT) could be strong contenders for future ETFs. These ETFs could offer investors a regulated way to gain exposure to the crypto market without the volatility associated with other cryptocurrencies.

- Multi-Cryptocurrency ETFs: ETFs encompassing a combination of diversified cryptocurrencies could come up, offering investors a broader exposure to the crypto market whilst reducing the risk associated with individual assets.

- Sector-Specific Crypto ETFs: ETFs focusing on specific blockchain sectors, such as DeFi or NFTs (Non-Fungible Tokens), could spring up in crypto over time. These ETFs would cater to investors interested in specific applications of blockchain technology.

However it's important to remember that the approval process for crypto ETFs remains complex and subject to regulatory scrutiny. Factors like the underlying asset's security, market manipulation risks, and investor protection measures will all play a significant role in the SEC's decision-making process.

Conclusion

The Ethereum ETF marks a great milestone in the progress of cryptocurrencies. While the full extent of its impact remains to be seen, it represents a significant step towards mainstream adoption and day-to-day use.