Decentralized Finance had arrived with a flicker of hope amidst the exhausting list of issues that the centralized system held. But it soon diminished as the shortcomings of DeFi made it unable to be a replacement for the existing system. Even after a substantial amount of time and effort, mass adoption seems to be a far-fetched goal to reach. From 2014's Mt Gox Bitcoin Hack to 2021's FTX Crash, several obstacles denied the mainstream adoption of DeFi. The technical and structural principles of Blockchains also add to the constraints resulting in unsustainability.

Solana appeared on the scene as a major competitor of Ethereum. But with higher scalability and cheaper rate, it reflected a new hope for DeFi. Despite its protocol advantages, some technical challenges still remain unresolved. As Solana wraps it up with its Annual Summit of Breakpoint, we will delve further into the topic following the reminiscences of the event.

Overview of Solana DeFi

Solana's DeFi ecosystem is relatively younger and smaller compared to Ethereum's DeFi landscape. However, it thrives due to its unique offerings and the possibility of building products not feasible on Ethereum. Aside from offering cheaper transactions than Ethereum, Solana's value proposition is to implement innovative designs that bring more value to users. However, due to the collapse of FTX and an exploit on Mango Markets, the ecosystem had to endure a significant drop in TVL and SOL token value in 2022.

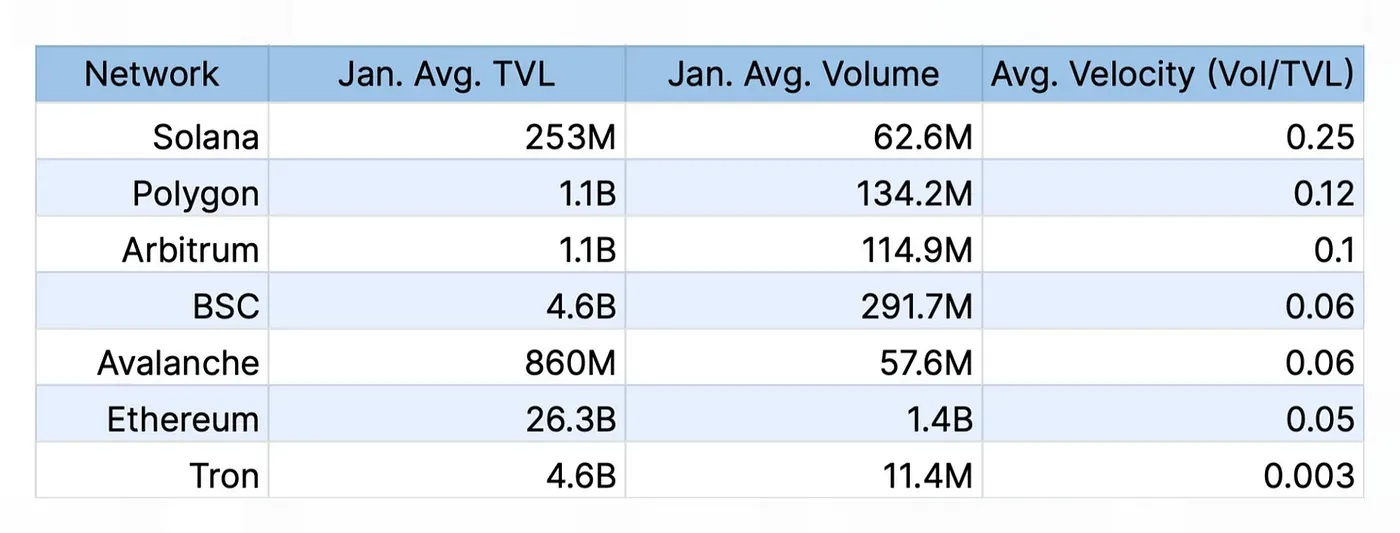

Despite this, Solana's daily transaction count remained strong, driven by its high throughput and expanding project and developer activity. In January 2022, Solana's DeFi Velocity was at least twice as high as other blockchain networks, suggesting that digital assets to be actively traded and capital efficiently utilized on Solana.

This ecosystem encompasses various categories, from DEXs to lending and borrowing. On-chain CLOBs, like Serum, are another enticing part of Solana DeFi. They offer various opportunities, such as scalability and the potential for on-chain Foreign Exchange (FX) markets. Phoenix by Ellipsis Labs is another CLOB alternative. Besides Solana's prominent DEXs like Orca, OpenBook, Raydium, Lifinity, and Aldrin, innovation continues with projects like Root Protocol, which combines AMM efficiency with order book flexibility. However, the gap between user experience in CEX and DEX is yet to be mitigated to achieve the ultimate goal of DEX. Additionally, projects like Credix Finance are exploring lending against real-world assets. These projects aim to create investment opportunities and enable easier access to capital for businesses, potentially expanding the use cases of collateralized lending.

In summary, Solana's DeFi landscape, while facing challenges, continues to evolve with potential for innovation and growth.

Solana's Compatibility with DeFi

The vision articulated for DeFi was to bring a financial and monetary structure free of central manipulation. Needless to mention, even after a substantial amount of time, Defi is yet to grow up and deliver a better financial system that outperforms traditional finance. For that, the focus should be on enabling rapid permissionless innovation and competing with traditional finance on the quality of liquidity and sustainability, rather than just relying on decentralization alone.

In DeFi, as opposed to TradFi's orderbooks and liquidity providers, trading occurs through AMMs mostly. Trading on automated market makers (AMMs) like Uniswap is limited by the constraints of Ethereum's low transaction capacity, resulting in higher spreads and no mechanism for price improvement. It is worse for both makers and takers compared to centralized exchanges like Binance, as the prices on AMMs are much worse due to the higher spreads in DEXs and the higher gas fees. This ultimately results in users choosing centralized platforms over platforms like Uniswap for trading. The Liquidity of AMMs is also unsustainable. Due to passive liquidity, the Liquidity providers rely on other traders to move their prices toward the current market price. To overcome such shortcomings, Ethereum moves most of the critical components off-chain to get around its infrastructure constraints. But Ethereum's approach involving off-chain RFQs, off-chain orderbooks and consolidation of orderflow trades off decentralization for performance hindering the ultimate purpose of DeFi.

On the other hand, Solana's approach to the existing DeFi issues is to relax the infrastructure constraints. With a high-performance chain like Solana, developers can build liquidity primitives that provide higher liquidity than AMMs. Apart from this, the high throughput and low transaction cost at the base layer allow fully on-chain protocols with uncompromising efficiency. Specifically, on-chain order books in Solana enable market makers to compete for flow by offering better prices, allowing for more efficient and competitive liquidity compared to automated market makers (AMMs) with high fixed spreads.

Despite having less liquidity than Binance, Phoenix on Solana offers tighter spreads, resulting in better prices for traders. Its high performance enables active liquidity, which is a unique advantage for market makers.

Firedancer to Upscale Solana's Performance

At the recent Breakpoint, the Solana Foundation made an exciting announcement, introducing Firedancer, the second node validator on the Solana testnet, signifying a massive step forward in the ongoing growth and development of the Solana blockchain.

Firedancer was developed under the guidance of Jump Crypto, with a clear mission in mind: to diversify node clients, enhance Solana's stability, and bolster its ability to withstand potential attacks. Unlike Solana's first client, Firedancer has adopted C/C++ as its development language to not only ensure compatibility and memory efficiency but also effectively reduce the costs associated with running Solana nodes.

It has already been implicated that Firedancer is a long-term solution to address potential interruptions in the Solana network. It boasts a remarkable capability to handle up to 1.2 million transactions per second (TPS).

Previously, the entire Solana network heavily relied on the original validator client developed by Solana Labs. However, Firedancer, will open up new possibilities and inject fresh vitality into the Solana ecosystem as it diversifies the client ecosystem and enhances the blockchain's resilience.

To achieve this, Firedancer introduces advanced transaction processing techniques, sharding capabilities, and optimizations for network and P2P communication protocols. It also enhances Solana's existing proof-of-stake consensus protocol, promising efficiency, reliability, and reduced operational costs for node operators.

A key element of Firedancer's technological innovation is its core component, fd_quic. Google's QUIC protocol, designed as the next-generation tool for internet data transmission, offers improved speed, security, and reliability compared to traditional TCP protocols. This integration of the QUIC protocol sets new standards for Solana's scalability, stability, and its ability to fend off DDoS attacks. This advancement is rooted in custom network stack design and Receive-Side Scaling (RSS) tailored for each CPU core, reducing computational burdens.

Firedancer's fd_quic also incorporates advanced data structures and algorithms, as demonstrated through compatibility, performance, and scalability testing. These tests have highlighted its technical superiority, with the potential to revolutionize the Solana network's performance.

Firedancer brings a series of innovations to the Solana network, enhancing its robustness and paving the way for broader applications of blockchain technology. These include diversified validator clients, a smoother user experience, and improved network stability. It addresses existing issues while laying the groundwork for sustainable growth and expansion of the Solana network. Although it is yet to go mainnet, the ecosystem has already set foot to a new phase of development.

Scaling the Future of DeFi on Solana

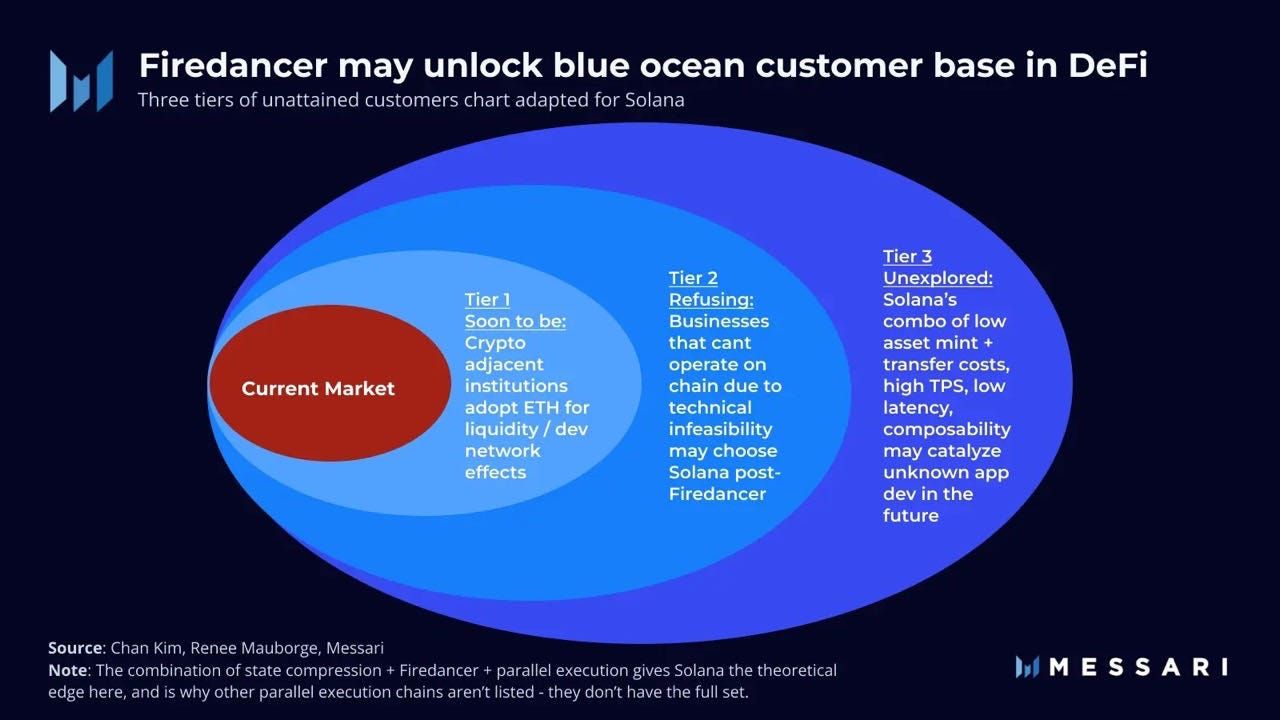

The advent of Firedancer has allowed existing DeFi on Solana to scale up their ambitions and fueled innovative approaches to the existing challenges. An overview of Solana's accomplishments through Firedancer is stated to be:

- Enhanced throughput: Firedancer can handle up to 1.2 million transactions per second, improving network speed.

- Diversified validator clients: Firedancer introduces client diversity, reducing the risk of network interruptions.

- Improved user experience: Users enjoy faster transaction processing and instant confirmations.

- Enhanced network stability: Firedancer optimizes resource usage, reducing the likelihood of node crashes.

- Long-term solution: Firedancer addresses network interruptions and enhances Solana's resilience.

- Reduced operational costs: Improvements in efficiency translate to cost savings for node operators

The aforementioned advantages lead to a more secure, reliable, interactive, and efficient ecosystem for DeFis to flourish. From a brief throwback to Solana's recent Breakpoint, we get to learn about many projects actively working on addressing the problems that were responsible for hindering the progress of DeFi. For instance, Orca is working on improving LP experience via features like Yield finder and increasing the profitability of LPs by allowing them to view time to profit ratio; DRIFT, another Solana-based project, is working to build a DEX that competes with CEX by making large-scale improvements in the UX for traders and introducing mobile interface to attract native traders. Most of their solutions either rely on or are expected to be enhanced by the chain's improved transaction speed, reduced cost structure, and a certain amount of resilience that Solana offers through Firedancer.

Conclusion

Solana's high performance gives leverage to its DeFi platforms to reach their ultimate potential. As opposed to Ethereum, the network has always had its fair share of fame for its unbeatable scalability. Now, with the addition of Firedancer to the scene, Solana DeFis are destined to reach new heights. As blockchain technology continues to mature, we look forward to how Firedancer will lead the Solana network and the entire blockchain industry toward a new and exciting future.