The digital age has been marked by two transformative revolutions: the rise of the internet and the emergence of cryptocurrencies. Both have redefined how we communicate, transact, and perceive value. This article delves deep into the intriguing parallels between these two monumental shifts, offering insights into their growth trajectories and potential future impacts.

The Dawn of the Internet

In the late 80s and early 90s, the internet was a budding concept, limited to research institutions and tech enthusiasts. The idea of a globally connected network was novel. Early users recall the iconic sound of dial-up modems and the thrill of sending their first email. Websites were basic, and search engines were in their infancy. Yet, the potential was evident. By the mid-90s, businesses began to recognize the internet's commercial potential, leading to the dot-com boom. Start-ups with a '.com' in their names received massive investments, and the world braced itself for a new era of digital communication and commerce.

Cryptocurrencies: The New Frontier

Fast forward to 2009, and another revolution was brewing. Satoshi Nakamoto introduced Bitcoin, the first decentralized cryptocurrency. The idea was simple yet profound: a peer-to-peer electronic cash system that operates without a central authority. Over the next decade, thousands of cryptocurrencies emerged, each with its unique value proposition. The decentralized finance (DeFi) movement took root, offering financial services without traditional intermediaries like banks. Just as websites were to the internet, decentralized applications (dApps) became the building blocks of the crypto ecosystem.

Drawing Parallels: Adoption Rates

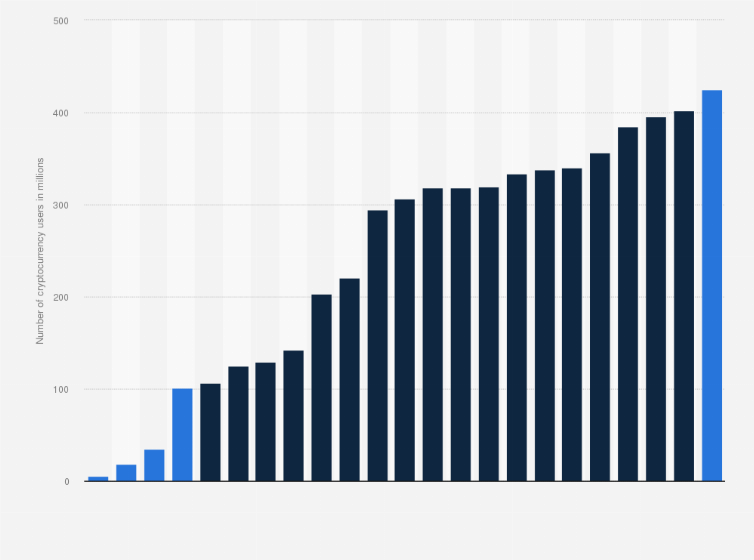

The adoption curve of both the internet and cryptocurrencies showcases striking similarities. The internet's user base saw exponential growth from the mid-90s to the early 2000s. Similarly, between 2018 and 2020, the global user base of cryptocurrencies surged by nearly 190%. These figures highlight a recurring theme: groundbreaking technologies often face initial scepticism, followed by rapid adoption as their utility becomes evident.

Market Dynamics and Valuations

The late 90s witnessed the dot-com bubble, a period characterized by soaring valuations for internet companies. This surge was primarily driven by speculation, investor enthusiasm, and the overarching belief in the untapped potential of the internet. Companies, irrespective of their profitability or business model, saw their stock prices skyrocket, simply because they had a '.com' in their names.

Similarly, the crypto market has experienced its own set of booms and busts. The meteoric rise of Bitcoin in 2017, followed by a sharp correction in 2018, is a testament to the volatile nature of cryptocurrency valuations. This volatility is influenced by a myriad of factors, ranging from regulatory news, technological advancements, market sentiment, to macroeconomic indicators.

One of the key drivers behind the high valuations in the crypto market is the concept of scarcity, especially with assets like Bitcoin, which has a capped supply. This artificial scarcity, combined with increasing demand, has led to bullish market sentiments. Additionally, the rise of institutional interest in cryptocurrencies has further legitimized the market, leading to increased stability and valuations. Major financial institutions, hedge funds, and even traditional banks have started to recognize the potential of digital assets, either by offering crypto-related services or by directly investing in them.

However, it's essential to note that while the potential for high returns exists, so does the risk. The decentralized nature of cryptocurrencies means they operate in a regulatory gray area in many countries. This lack of clear regulatory frameworks can lead to sudden market shifts. For instance, announcements of regulatory crackdowns in major markets like China or the U.S. have historically led to significant price corrections.

The global cryptocurrency market, valued at USD 826.6 million in 2020, is projected to touch USD 1,902.5 million by 2028 as stated by Fortune Business Insights™️. These trends underscore the market's confidence in the long-term potential of digital assets.

The Road Ahead: Challenges and Opportunities

The journey of cryptocurrencies, while promising, is riddled with challenges. One of the most prominent challenges is scalability. As more users adopt cryptocurrencies, networks like Bitcoin and Ethereum face congestion, leading to slower transaction times and higher fees. Solutions like the Lightning Network for Bitcoin and Ethereum 2.0 aim to address these scalability issues, but they are still in development or early adoption phases.

Security is another significant concern. Despite the inherently secure design of blockchain, the broader crypto ecosystem has witnessed numerous hacks, especially on cryptocurrency exchanges. These security breaches have led to the loss of millions of dollars worth of digital assets, shaking investor confidence and leading to calls for better security protocols.

Regulation, or the lack thereof, is a double-edged sword for the crypto industry. On one hand, the absence of clear regulations allows for innovation and rapid growth. On the other, it leads to uncertainty. Investors, developers, and users are often left in the dark about how governments might treat their crypto holdings or projects. This uncertainty can stifle innovation and deter institutional investment.

Furthermore, the environmental impact of cryptocurrencies, especially proof-of-work assets like Bitcoin, has come under scrutiny. The energy-intensive mining process has been criticized for its carbon footprint, leading to debates about the sustainability of such networks. In response, many in the crypto community are exploring or adopting more energy-efficient consensus mechanisms, like proof-of-stake.

Lastly, the issue of mass adoption remains. While the number of crypto users has been growing steadily, it's still a fraction of the global population. For cryptocurrencies to realize their full potential, they need to be adopted widely, not just as speculative assets but as mediums of exchange. This requires user-friendly interfaces, increased public awareness, and real-world use cases.

While the challenges are manifold, they represent growth areas for the industry. Addressing these challenges head-on will not only stabilize the market but also pave the way for the next phase of growth and innovation in the crypto space.

Conclusion

The parallels between the internet and cryptocurrency revolutions offer valuable lessons. Both represent more than just technological advancements; they symbolize shifts in societal values, emphasizing decentralization, autonomy, and global connectivity. As we navigate the digital age, it's crucial to understand these shifts, embrace change, and actively participate in shaping the future. The crypto revolution, much like the internet boom, is here to stay, promising a future of endless possibilities.