If you've been exploring the world of NFTs, you may have encountered platforms that feature automated market makers (AMMs). If you're curious about how these platforms differ from traditional NFT marketplaces, you've come to the right place. In this article, we'll discuss NFT AMMs, their benefits and drawbacks, and whether or not they're right for you.

How Do NFT AMMs Work (Explained Like I'm 9)?

If you follow crypto, you've probably heard about decentralized exchanges like Uniswap or Pancakeswap. These web3 protocols primarily use AMMs for near-instant token swaps, and NFT AMMs are powered by similar mechanisms. The goal is to allow traders to instantly buy or sell NFTs through liquidity pools.

But what is an automated market maker and a liquidity pool? Well, an AMM is a type of decentralized financial protocol that allows digital assets to be traded without traditional intermediaries like brokers or exchanges.

Liquidity pools are essentially large reserves of digital assets provided by users or even NFT project creators. In return for supplying assets to these pools, liquidity providers receive a share of the trading fees generated by the AMM.

AMM marketplaces enable the creation of liquidity pools, pairing your chosen NFT with the platform's supported token (e.g., DexterLabOG/SOL or Azuki/ETH). Anyone can buy an asset from liquidity or sell into it anytime without waiting for someone to agree to your price.

NFT AMM or NFT Marketplaces?

One of the drawbacks of NFT AMMs is that you can't set your desired NFT price. Instead, prices are set by an algorithm that relies on supply and demand forces. This usually means the price at which an NFT can be sold instantly will be a little lower than the floor price. For this reason, NFT AMMs are not the best option for rare items valued much higher than common NFTs. If you're not in a rush and prefer to wait for a buyer to agree to your price, traditional NFT marketplaces are the way to go.

However, this drawback is also a benefit. People eager to sell as soon as possible don't need to undercut the floor price and collections can better sustain their value. The price will still be affected negatively when the supply exceeds the demand but the floor value will be set by mathematical algorithm rather that human emotion.

As mentioned above, liquidity providers can earn fees from the trading activity they create. This is great for whales who hold large NFT bags as they can create a passive revenue stream. However, they must provide liquidity for both the buyer and the seller sides when the pool is created, meaning they should deposit NFT items and also cryptocurrency like ETH or SOL.

What's In It For You?

The emergence of NFT AMMs was definitely disruptive in the NFT world. Up until July 2022, when the first AMM NFT marketplace Sudoswap launched on Ethereum, traders and collectors constantly faced the problem of poor liquidity for NFTs. A token on a traditional NFT marketplace might sell when a collection is on a hype cycle or is a popular project in general. However, even undercutting the floor price doesn't guarantee an instant sale. NFT AMMs offer a solution to this painful problem, providing additional benefits on top of it, and it didn't take long for other NFT AMMs to emerge on other chains as well. Right now, most networks that have NFT activity can offer NFT AMMs.

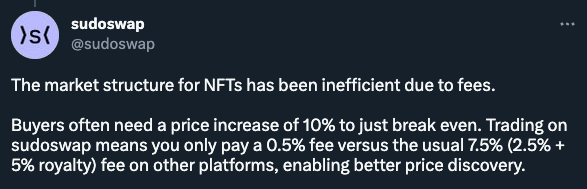

Another significant advantage of NFT AMMs for traders is that they can bypass creator royalties, which has become a hot topic in the NFT world in the latter half of 2022 following the emergence of marketplaces such as Sudoswap and Hadeswap.

However, while traders benefit from lower fees, creators may suffer a loss of income, which could potentially harm the NFT space in the long term. Various attempts have been made to safeguard creator royalties, but exploring this topic is beyond the scope of this article.

In Conclusion

NFT automated market makers have disrupted the NFT world by providing a solution to the liquidity problem that traders and collectors have faced for a long time. Although NFT AMMs have some drawbacks, such as the inability to set your desired NFT price, they offer benefits such as near-instant buying and selling, the creation of liquidity pools, and the potential for liquidity providers to earn fees.

Whether or not you should use NFT AMMs depends on your personal preferences and the nature of the NFTs you're trading. Nevertheless, NFT AMMs have established themselves as a powerful tool in the world of NFT trading, and they will likely continue to play an important role in shaping the future of this exciting space.