Atadia aims to bring into the decentralized market a credit-based lending system providing liquidity for those who need it. First, in the Solana NFT space, and later, in the Ethereum and Near protocol networks.

Atadia will be releasing three products. The first product is already live, although it is still being refined. The founder hinted that the second product will likely involve NFT shopping automation, perhaps a snipping tool. At this point, the particulars of the third tool are a secret.

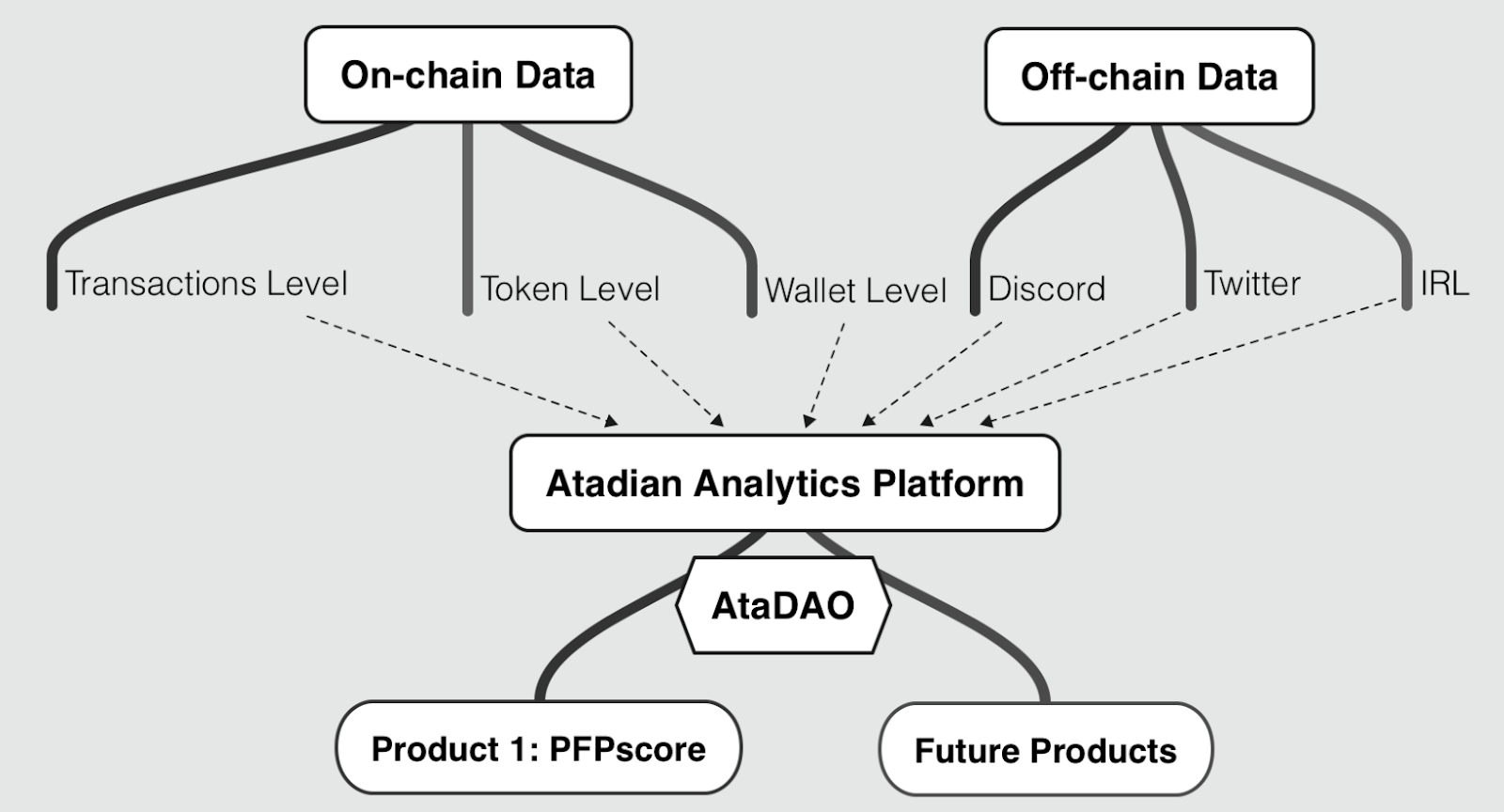

The first product the team is working on is "PFPscore." It is a scoring engine that combs through the Solana blockchain data and social graphs to capture reputation and credit worthiness.

To provide a "PFPscore" the tool will collect and aggregate data such as:

- Wallet behavior including transaction volume and frequency, NFT holding periods, purchasing patterns, and other data available on a blockchain.

- NFT metadata containing the characteristics of NFTs held in wallets, from price to rarity and other collection-specific metadata.

- The social graph, which can reveal someone's social position and tell how much an individual can lose if his social reputation is damaged.

- Web3 credit history with a track record of payment and credit histories.

Take a loan without collateral in a few easy steps

PFPscore is the engine behind the Atadia Lending Lab, a platform where you can take uncollateralized loans. Right now, while the product is in the early stage, up to 4 SOL for users with high PFPscore, or 1 SOL for new users.

The process of registering for the loan is straightforward and hassle-free. On the Atadia Lending Lab platform, you only need to connect your Twitter account, submit your wallet address, and you're good to go. No collateral is required, but you must repay the loan in one week with 5% interest. So, if you borrow 1 SOL this Monday, you have to pay 1.05 SOL the following Monday. Atadian NFT holders have the luxury of using the service without paying the interest fees.

You may wonder, what if I don't pay back? Well, in this case, your PFPscore will take a tremendous hit, and you likely won't be able to use the service again. They will also put you on their blacklist, which will be shared with all of their Solana Media partners, Twitter, and those in charge of your DAO, making it more difficult for you to be whitelisted in any future projects.

Is this prevention effective enough in the NFT world full of scammers? Anyone can create new wallets and Twitter accounts and drain the SOL from the platform, right?

Well, the team has built an algorithm that detects the people who try to rig the system. They say it is good at it. In fact, Atadia claims that they have over a 90% repayment rate at this point.

If done right, uncollateralized loans can transform the industry. So far, lending has been fueled by over-collateralization in WEB3. Plus, not many people are willing to use their bellowed NFT as collateral for 30% of its floor price value, then pay Premium for short-term lending.

Collateral-free lending powered by PFPscore is just a first step. Atadia aims to enable new use-cases such as mint mint-now-pay-later, hiring, pre/post rug investigations, verification checks and more.

Atadia team

The people behind Atadia aren't newbies. The founder has a successful track record working with large businesses and building credit scores in other non-web3 fields. Behind him is a team full of experts in data science and credit scoring.

The project's mastermind, Puppet M◎nkester is an economist and a data technologies entrepreneur expertizing in econometrics, machine learning, credit scoring, retail & geo-analytics, and fraud & malpractice detection. He has 10+ years of experience in the analytics business and big data monetization.

After launching the NFT collection OG Atadians, Puppet hired ten new people to work on various aspects of the project. Currently, there are over 20 people on the team. Many of them are experts in data science and the economy. The team also includes front-end and back-end developers, a writer, NFT experts, moderators, and an award-winning artist illustrator specializing in nature-inspired pencil drawing. Her clients include Louis Vuitton, The Ritz-Carlton, L'OCCITANE en Provence, and Crabtree & Evelyn, to name a few.

The art of OG Atadians is very detailed and complex. The collection is very diverse, and each piece looks like something you could hang on a wall without your guests (who know nothing about NFTs) questioning the artistic value of the painting.

What is the OG Atadian NFT, and what are the benefits of holding one?

OG Atadians are the genesis collection containing 5000 NFTs. The collection serves as a "pre-seed" round for Atadia to secure funding while bringing multiple benefits to its holders.

First of all, the NFT provides exposure to the growth and success of the project. For every product released under Atadia, the revenue fees will be split with OG Atadian holders. Owners will also benefit from early access to any future mints of product-based NFT collections.

Holders also receive rewards for their staked OG Atadia NFT. 40% of the total supply is allocated to the NFT holders, and it will be distributed over 2 years.

Additionally, Genesis Collection NFTs will give access to the ARG (Alternate Reality Game). The game will allow players to join 1 of 4 factions and form resistance against Atadia's Supervillain. ARG will not only be fun, but it will also unlock an additional 10% of the total supply of $ATA to Atadia NFT holders.

The total of $ATA a holder can receive over two years from staking and game bonuses will amount to 80,000 $ATA per NFT, which is 109 $ATA per day per NFT.

The PFPscore engine will also affect the OG Atadia NFT holders. A higher PFP score combined with NFT ownership will give a better chance to secure future partner of Atadia NFT collections whitelists spots.

Tokens of the ecosystem

$ATA is the main currency of the ecosystem with the supply capped at 1 billion tokens. The payment for the services of Atadia will be implemented in $ATA. Users can also pay in SOL, but spending with ATA yields greater discounts. Some exclusive services will be only available in $ATA. If the products the team is building are popular, such a utility can help to maintain the token demand.

Until the public IDO, some time in 2022 Q4, $ATA has no liquidity pool and can't be traded. However, NFT holders can already stake their Atadians to earn $ATA rewards.

7.5% of $ATA is allocated to the private investors, and it will be sold in 2 rounds. The first batch of the private tokens was sold out in January 2022. The second private sale round is supposed to happen 1-2 months after the mint, which should be around May - June.

Team allocations of 13% are vested linearly with a 12-month lockup period. 2% advisor tokens are vested linearly for nine months.

The details about vesting schedules for the private round tokens aren't disclosed in the whitepaper. Although, the team points out that they very carefully select who they are working with.

$ATA isn't the only token that will power the ecosystem. There will also be a $PTT token, which will have superior functionality for future mints. It will also provide voting rights. NFT holders can earn it through staking or convert for $ATA, which is burned as a result.

Final thoughts

Atadia stands out from most of the NFT projects – the vision is very ambitious, and the team seems capable of succeeding.

The generic market for PFPscore is vast. The consumer credit + credit cards market stands at $ 200 billion a year only in the US. Even a tiny piece of the pie can be very significant. More than that, innovation can bring new opportunities for many people around the world who do not even have or can't get a credit score.

OG Atadians NFT collection leaves a good impression too. 50% of the token allocation to the NFT holders can be a big deal if the token holds value. The truth is that most holders will evaluate their NFT by the amount of passive income it generates. If the token can maintain a value of around 1 USD, this would mean that an owner can earn ~$100.00 per day passively. However, with the 1 billion $ATA supply, I assume this is less than likely, especially when there will be constant sell pressure coming from the holders selling their rewards.

I think that at this point, the token lacks utility. Creating the demand through whitelist spots available to purchase in $ATA will not be enough to create the demand. Now, plenty of NFT collections can offer whitelist spots to their community in one way or the other, so NFT degens have more than one option to get the whitelist spots.

The demand for the token will be very much tied to the success and usage of the Atadia services, as users will be incentivized to pay for them in $ATA.

So, while the team and their vision is great, they still need to prove if they can support the value of the token and NFTs which depends on the growth of Atadia.

The project hasn't generated massive interest yet. Atadia has over 10 thousand followers on Twitter and over 16 thousand Discord members. The activity is pretty low on both platforms compared to other NFT projects of similar valuations. Perhaps Solana NFT buyers are more interested in cartoon images than the artwork made by an actual artist? Or perhaps, they can't wrap their heads around what the Atadia is all about yet? Or maybe, people aren't that interested in collateral-free loans at all?

Future will answer the questions, but right now, it's nice to see the teams with big ambitions coming into the Solana NFT world, trying to create something new, something no one has attempted yet.