Despite the rise in perpetual futures trading in crypto, a significant gap remains between the trading volumes of crypto derivatives in Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). The advent of Breakpoint 2023 has highlighted the potential of the Solana Blockchain to bridge this gap, instigating a new era of crypto trading.

Perpetuals (perps) have significantly surpassed spot trading volumes, with CeFi perps witnessing remarkable growth due to their inherent advantages over spot trading. In contrast, DeFi perps, being a relatively recent addition to the market, have experienced a more gradual expansion. Over the past two years, the growth of DeFi perps has been comparatively slower, accounting for only one percent of the CeFi perp market.

Notably, decentralized exchanges (DEXs) such as DRIFT and Jupiter on the Solana blockchain have been steadfast in their efforts to integrate perpetual futures trading on-chain. In light of the development of Firedancer, which has significantly improved the chain's scalability and performance, it is more likely than ever that we are currently on the cusp of achieving a genuine and sustainable decentralized exchange (DEX) for perpetual trading.

How do Perpetual Futures work?

Crypto Perpetuals are a type of derivative known as "futures" that lets its purchasers speculate the price of an underlying cryptocurrency. Purchasers of these contracts bet on an asset to be under or above a certain price level after a fixed amount of time. Traders who believe the price will rise will take the "long" position and those who believe the price will fall will take the "short" position. If the price rises after the given time, the long position holder profits and if the price falls, the short position holder profits.

While this is roughly how traditional futures work, perpetual futures have slightly different mechanisms because these contracts are without an expiration date. In case of perps, instead of automatically closing the position, one has to manually exit the position until they are satisfied with their profit margin. Another important feature is the "Maintenance margin". It is the minimal amount of collateral that traders need to keep in their accounts to maintain their position. If the collateral in the trader's account falls below the given maintenance margin, his/her trades will be automatically closed causing "liquidation". To increase the size of their position, traders can borrow funds known as "leverage". This increment. although acting in favor of traders is often not worth the risk since the possible loss is also amplified in amount. Adding on, perpetual futures also come with funding rate mechanisms to maintain the perp's value with the underlying asset price. Based on the price of the underlying asset, a certain amount of fee is either deducted or added to the holder's account. For instance, if the price goes above the perpetual's price, the funding rate mechanism will change the long fees to pay to shorts and vice-versa. This incentivizes traders to buy or sell perp contract in balance with the price of underlying asset.

Perps on Decentralized Exchanges

Decentralized Exchanges operate on blockchain networks, allowing users to continuously trade digital assets without the need for matching buyers and sellers. These exchanges are permissionless and non-custodial, meaning anyone can access them while maintaining control of their funds.

Instead of traditional order books, perpetual DEXs use Automated Market Makers (AMMs) that employ mathematical formulas based on asset supply in liquidity pools to determine prices. Traders can instantly buy or sell assets, and the AMM adjusts prices by rebalancing the pool to keep asset values roughly equal.

Liquidity providers play a key role by adding equal values of two assets to earn trading fees. High volumes of traders and deep liquidity pools are crucial for a DEX's success. Especially for perpetual futures, abundant liquidity facilitates continuous trading. Low liquidity may result in slippage, making it challenging for traders to enter or exit positions at desired prices. DEXs usually incentivize market makers, offer a variety of perpetual contracts for major crypto assets, charge low or no fees, and foster an active trading community through engagement on social media and online forums to maintain liquidity.

Liquidity providers receive LP tokens representing their pool share, redeemable at any time with accrued fees. While adding liquidity has risks, deep liquidity pools on perpetual DEXs lower the likelihood of impairment loss.

Solana's Role in Revolutionizing DEXs

DeFi perps, at their core, represent a superior product that aligns seamlessly with the principles of decentralization. When trading a permissionless currency, it logically follows that the platforms and methods employed should embody a similar permissionless nature. Conversely, centralized platforms present a slew of issues, including opacity, KYC/AML compliance complexities, regional trading red tape, single-point failures, and the necessity to trust the exchange. Decentralized exchanges (DEXs) offer a solution to these issues.

However, DEXs, right now, aren't quite hitting the same highs as their centralized counterparts in terms of returns and operability. Established DEXs like Uniswap roll with an Automated Market Maker (AMM) structure, causing noticeable price gaps for the same cryptocurrencies compared to big shots like Binance. That's why traders often lean towards the centralised exchanges. And for the market makers or Liquidity Providers, the gains aren't exactly enticing.

In this regard, Solana is a game-changer with its rapid transactions and minimal fees, paving the way for on-chain orderbooks that tackle these challenges head-on. Solana's knack for efficiency lets DEXs run fully on-chain without compromising the perks of traditional trading platforms. Centralized platforms have always championed speed, low latency, and slashed fees – and Solana can replicate it all. The current blockchain capacity even hints at faster user confirmation times, putting Solana in the spotlight as a promising platform that fuses decentralization perks with all the favorable parts of centralized exchanges.

DRIFT

DRIFT, Solana's largest perpetual Decentralized Exchange, commenced operations in 2021 with its current V2 iteration, featuring an orderbook, Automated Market Maker (AMM), and Just-in-time liquidity marketplace to emulate Centralized Exchange user experiences. Since inception, DRIFT has facilitated over $11 billion in trading volume through 5 million trades, boasting a Total Value Locked (TVL) of $22 million and a 95% market share for perpetual trading on Solana.

Two of its major achievements come from the launch of Super Stake SOL and Drift Draw, which is a recent addition, that gathers trading fees in an ever-expanding pool known as the DRIFT pool. Traders receive 10 tickets for every dollar traded, encouraging increased trading activity and fostering the pool's growth in a positive feedback loop.

In the recent Solana Breakpoint, DRIFT outlined its ambitious goal of "eating CeFi's lunch." The platform actively addresses trading accessibility issues through its collaboration with Metamask, simplifying access for non-Solana users and eliminating the cumbersome process of connecting through wallets or transferring funds from a centralized exchange. Its partnership with Circle enables seamless USDC transfers within seconds.

To further enhance accessibility, DRIFT is developing a mobile UI. Collaborating with Phantom Wallet, the platform introduces an auto-confirm feature, streamlining the trading process with a single-click confirmation instead of the traditional 3-4 steps. DRIFT also teams up with Squads to bring an institutional Centralized Exchange (CEX) experience on-chain through Multi-sig accounts with 2FA.

For liquidity providers, DRIFT enables any user to offer liquidity to traders with a single click. The platform incentivizes users to engage in Insurance Fund Staking, ensuring the protocol is community-run and serves the community.

Jupiter

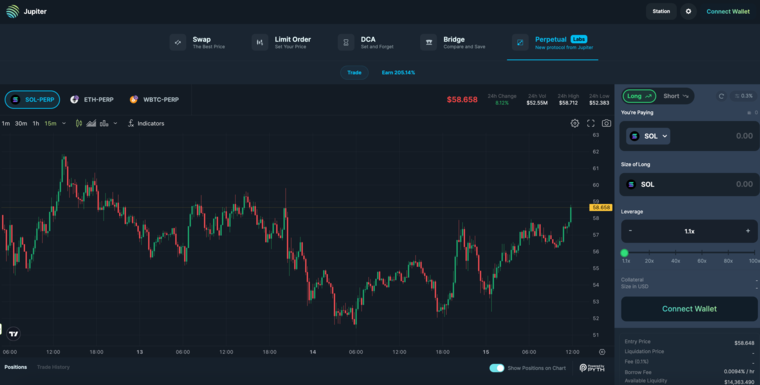

Jupiter, Solana's pioneer DEX Aggregator, prioritizes providing users with optimal Solana coin prices, low slippage, and minimal gas fees. The platform focuses on delivering a user-friendly experience and robust tools for developers, ensuring easy access to top-notch swaps in applications, interfaces, or on-chain programs.

In November 2022, during a bear market, Jupiter committed to reinforcing its presence on Solana, yielding substantial progress in 2023. This period witnessed the launch of innovative products, new routes, and improved developer infrastructure, featuring highlights like Metis (a Solana-customised routing algorithm), instant staked SOL to SOL swaps, Dollar Cost Averaging, Limit Orders, and the Bridge Comparator. By October 2023, the platform achieved a cumulative trading volume of $35 billion, 102 million transactions, and amassed 955,000 unique wallets, solidifying its status as the leading trading platform. Jupiter's success is attributed to core anchors: the JUP Promise, maximizing Solana's technical capabilities, and enhancing Solana's liquidity landscape.

The launch of the Jupiter Plan introduces the $JUP Governance Token, Jupiter Start, and Jupiter Labs. The $JUP token aims to attract capital and users to Solana, fostering momentum for new ecosystem tokens and a vibrant community. The Jupiter Start initiative reshapes the launchpad experience, focusing on long-term project success, community support, and ecosystem health. Collaborating with the community and JUP DAO, Jupiter Labs plans to unveil DeFi protocols, enriching Solana's DeFi ecosystem.

One of the two initiatives of Jupiter Labs involves launching an LP to traders perpetual exchange that offers up to 100x leverage. Unlike traditional AMMs, by utilizing pool liquidity and oracles, it ensures zero price impact, zero slippage, and deep liquidity. Oracles are supposed to enable stable market operations during liquidations and stop-loss events, removing risks of position bankruptcy and LP pool fund loss. Users can open and close positions in one simple step, eliminating the need for additional accounts or deposits. With Jupiter Swap integration, any Solana token can be used to open positions. The LP pool is also integrated with Jupiter to provide liquidity to the broader Solana ecosystem. Jupiter users can swap using the liquidity from the LP pool.

Conclusion

As the crypto space evolves, there’s a clear trend toward the proliferation of crypto derivatives products. Perpetual DEXs represent a substantial step in this direction, highlighting the industry’s recognition of the vast potential that derivative instruments hold.

The recent developments on the perpetual DEX model, based on Solana, not only provide a glimpse into the forefront of decentralized technology but also underscore the significant progress made while illuminating the path that lies ahead. The potential of crypto derivatives, exemplified by perpetual DEXs, extends well beyond their current state, with ongoing innovations and refinements expected to further shape the landscape.