Decentralized finance (DeFi) has grown in popularity over the past year, with billions of dollars in value locked up in various protocols and applications. One of the key values of DeFi is the ability to earn rewards and interest on your crypto assets, rather than just holding them in a wallet or on an exchange.

Staking is one of the most popular ways to earn rewards in DeFi. By locking up your tokens in a smart contract or staking pool, you can participate in network governance, validate transactions, and earn a share of the network's fees and inflation. However, staking also has its drawbacks and cons.

The most significant drawback or con of staking is the lack of liquidity. When you stake your tokens, you're basically locking them up for a set period, usually ranging from a few days to several months. This can be problematic if you need to access your funds or want to take advantage of other DeFi opportunities.

Liquid staking layers like Sanctum are solving this problem by allowing users to stake their tokens and have access to their liquidity simultaneously. In this article, we'll take a critical look at the concept of liquid staking layers, their benefits and drawbacks, and Sanctum's implementation on the Solana blockchain.

What are Liquid Staking Layers?

Liquid staking layers are a type of DeFi protocol that allow users to stake their tokens and receive a corresponding number of liquid tokens in return. These liquid tokens can be freely traded, used as collateral, or incorporated into other DeFi protocols, providing users with the benefits of staking and liquidity.

Liquid staking layers typically consist of two main components: a Staking pool and a Liquidity pool. The staking pool is where users deposit their tokens to participate in staking Whilst the liquidity pool is where users can trade their liquid tokens or provide liquidity to earn additional rewards.

Liquid staking layers can be implemented on various blockchains, each with its unique features and capabilities. Here in this piece, we'll be exploring the pros and cons of liquid staking layers with a focus on Sanctum on the Solana blockchain.

Benefits of Liquid Staking Layers

Liquid staking layers offer several benefits to users and the broader DeFi ecosystem.

- Liquidity: The most significant benefit of liquid staking layers is the ability to maintain liquidity while staking. By receiving a corresponding amount of liquid tokens, users can access their funds or take advantage of other DeFi opportunities without unstaking their tokens and waiting for the unstaking period to expire.

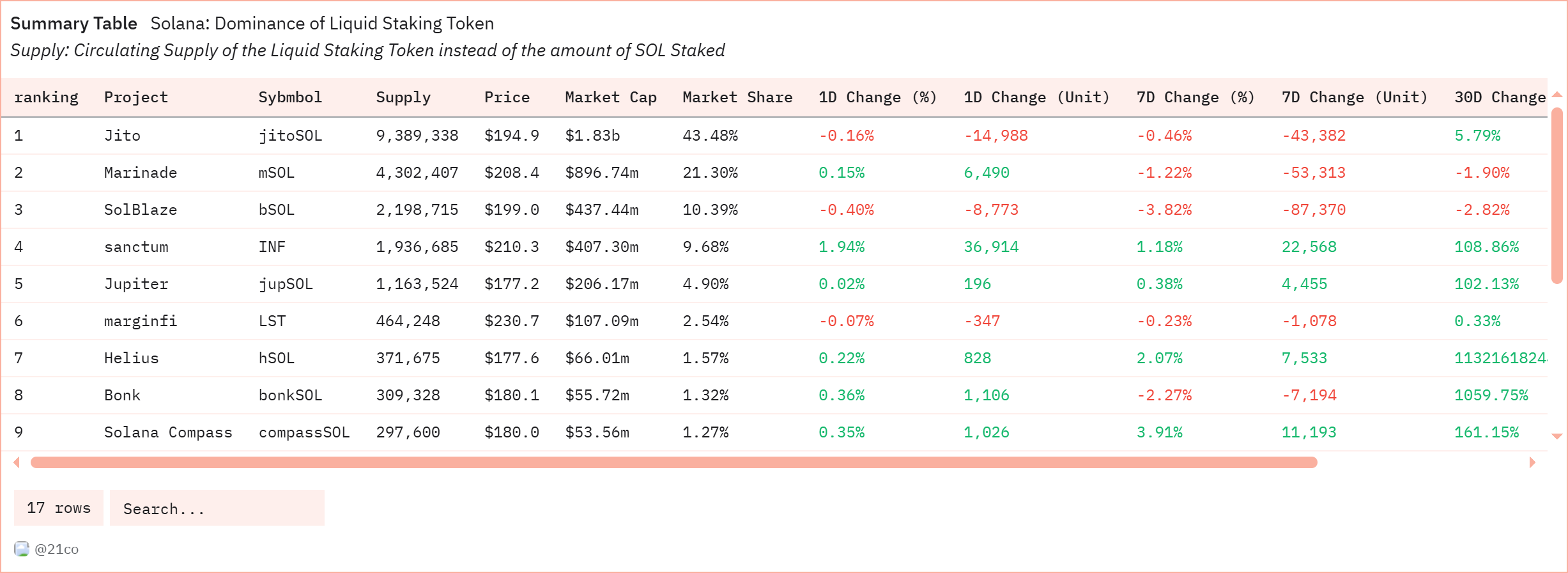

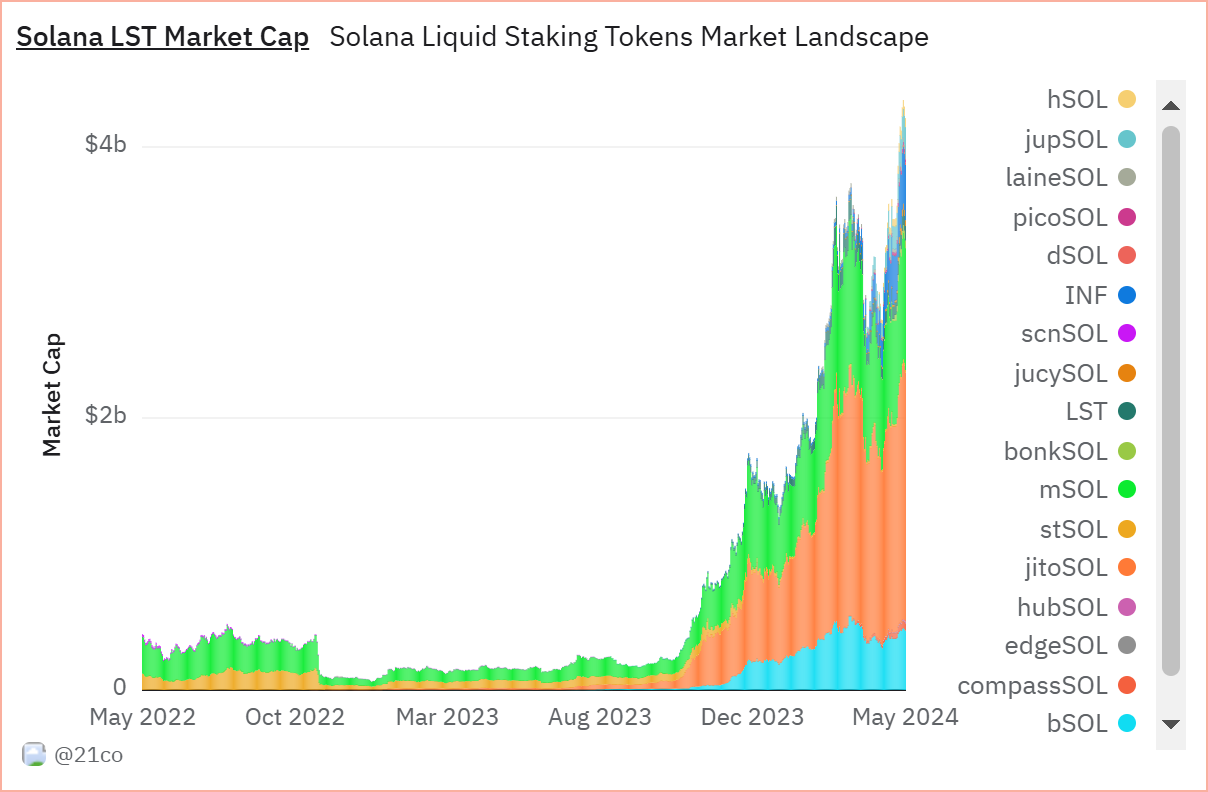

🚨 REPORT: The Market Cap of Liquid Staking Tokens (LSTs) on @solana has surged from $1.6B to over $3.5B since the start of 2024.

— SolanaFloor (@SolanaFloor) May 7, 2024

▶️Growth: 123%

▶️Market Cap increased: 1.98 Billion.

(LST is the Untapped Potential for Solana DeFi, which could boot their TVL by 1.5B to $17B). pic.twitter.com/AhCdEACgj9

- Diversification: Liquid staking layers also allow users to diversify their DeFi portfolio. By incorporating their liquid tokens into other DeFi protocols, users can earn additional rewards and reduce their exposure to a single protocol or asset.

- Increased Staking Participation: Liquid staking layers can also increase staking participation and network security. By reducing the barriers to entry and providing additional incentives, liquid staking layers can attract more users to stake their tokens and participate in network governance.

- Capital Efficiency: Liquid staking layers can also improve capital efficiency in DeFi. By allowing users to stake and maintain their liquidity, liquid staking layers can reduce the amount of capital that's locked up in staking pools and increase the amount of capital available for other DeFi applications.

Downside of Liquid Staking Layers

Despite their benefits, liquid staking layers also have several drawbacks and risks that users should be aware of.

- Smart Contract Risk: Liquid staking layers rely on smart contracts to manage the staking and liquidity pools. These smart contracts can be vulnerable to bugs, exploits, and hacks, which can result in the loss of user funds.

- Liquidity Risk: Liquid staking layers also rely on the liquidity (i.e. the ease with which tokens can be swapped to other tokens) of their liquid tokens. If there's not enough liquidity in the liquidity pool, users may not be able to trade their liquid tokens or access their funds.

- Regulatory Risk: Liquid staking layers may also be subject to regulatory risks and scrutiny. Depending on the jurisdiction, liquid staking layers may be considered securities or investment contracts, which can result in regulatory action and legal consequences.

- Complexity: Liquid staking layers can also be complex and difficult to understand for new or inexperienced users. The various components and mechanics of liquid staking layers can be overwhelming and may discourage some users from participating.

Sanctum: The Unified Liquid Staking Platform

Sanctum is undoubtedly a game-changer for Solana's liquid staking ecosystem. It functions as a unified liquidity layer for various Solana-based LST providers. Sanctum simplifies participation in liquid staking by having;

- Unified Platform: Sanctum acts as a single point of entry for accessing a diverse range of LSTs offered by different validators. Users no longer need to navigate multiple platforms, streamlining the process.

- Enhanced Liquidity: Sanctum facilitates aggregation of liquidity across various LST pools, resulting in deeper liquidity for users and tighter spreads when buying or selling LSTs.

- Frictionless User Experience: Sanctum provides a user-friendly interface for staking SOL, converting SOL to LSTs and vice versa, and managing their LST holdings.

- Innovation Hub: Sanctum fosters innovation within the Solana ecosystem by offering customizable LST functionalities. Projects can leverage LSTs for unique purposes, such as integrating them with NFTs or creating subscription services.

Benefits of Using Sanctum and LSTs

For users, Sanctum and LSTs offer several advantages:

- Increased Staking Participation: By eliminating the illiquidity barrier, Sanctum encourages wider participation in staking, ultimately contributing to the security of the Solana network.

- Flexibility: Users can participate in staking while maintaining access to their SOL for other DeFi activities, optimizing their DeFi experience.

- Choice of Validators: Sanctum allows users to choose LSTs based on factors like validator fees, reputation, or additional features offered by specific validators.

- Potential for Higher Returns: Some LSTs offer features like capturing validator fees or MEV (Maximal Extractable Value) rewards, potentially leading to higher returns compared to traditional staking.

- Gamification (Optional): Sanctum introduces a gamified approach through "Pets," which represent LSTs. Users earn experience points and level up their Pets by holding LSTs, adding a unique element to the experience. (Note: This feature might be subject to change or future development)

Popular LSTs on Sanctum

Sanctum supports various LSTs, each with its unique features and benefits. Here are a few examples:

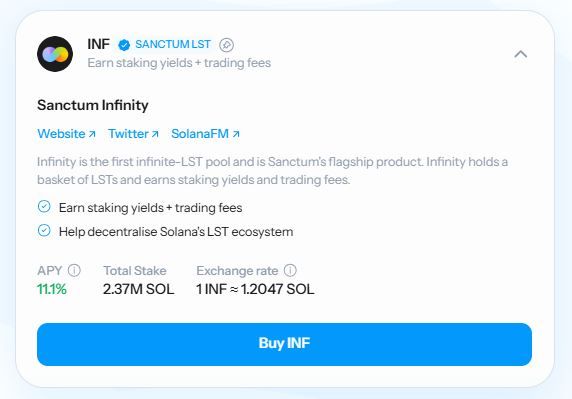

- Sanctum LST (INF): Sanctum's native LST, it represents a basket of various LSTs on the platform, offering users diversified exposure to different validators.

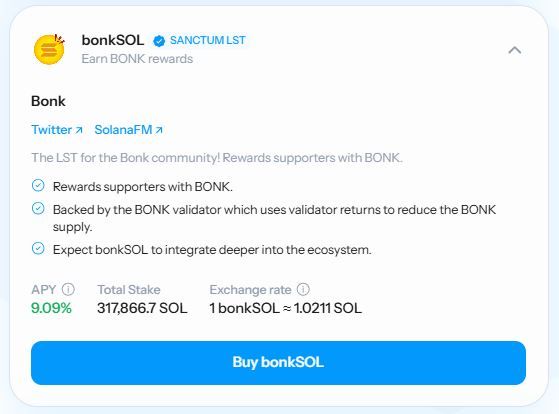

- bonkSOL: This LST allows users to earn BONK rewards in addition to staking rewards, appealing to users who hold BONK, a popular meme coin on Solana.

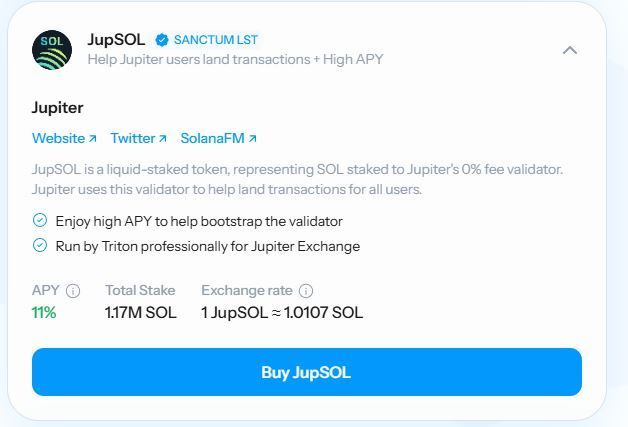

- jupSOL: This LST from Jupiter, a leading developer platform on Solana, provides users with access to the Jupiter ecosystem.

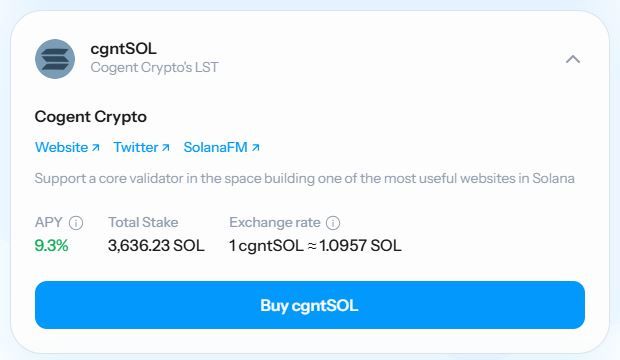

- cgntSOL: This LST potentially offers higher returns by capturing validator fees and MEV rewards generated by the underlying validator.

Conclusion

Liquid staking layers are an exciting and innovative development in the DeFi ecosystem. By allowing users to stake their tokens and maintain their liquidity, liquid staking layers can unlock new opportunities and rewards for users and the broader DeFi ecosystem.

However, liquid staking layers also have their drawbacks and risks, such as smart contract risk, liquidity risk, and regulatory risk. You should be aware of these risks and do your own research and due diligence before participating in any liquid staking layer protocol.

Sanctum's implementation on Solana is a promising example of how liquid staking layers can be designed and built for scalability, speed, and low-cost transactions. By leveraging these unique features and capabilities, Sanctum aims to offer a fast and low-cost liquid staking experience for users and contribute to the growth and development of the Solana ecosystem.