ZK-rollups or zero knowledge rollups is an L2 scalability solution allowing faster and cheaper transactions for blockchains.

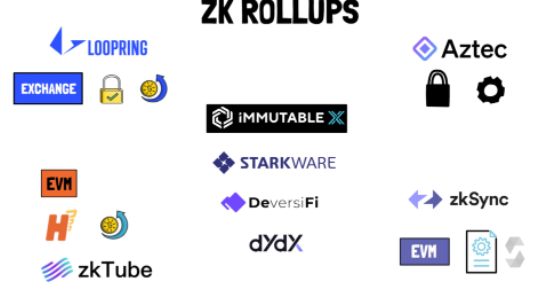

The projects which are using ZK-rollups include ImmutableX, dYdX, Sorare, zkSync 1.0, Arbitrum, Loopring, Aztec, Hermez Network, Fuel Network, Cartesi, OMGX, and that’s not even the full list.

Although other L1s are cheap and fast right now, with the growth of the crypto market they will become more and more congested so, in the future ZK-rollups might be the go-to solution for more blockchains than just Ethereum.

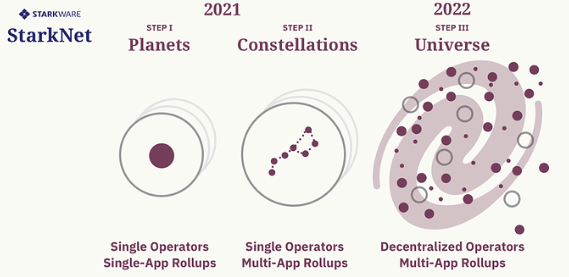

But the current ZK-rollups solutions have limited capabilities of the technology and this is going to change with the release of StarkNet and zkSync 2.0. Both of them will offer a full smart contract functionality and are the next evolution phase of ZK-rollups L2s.

Just yesterday, 29th of November, StarkWare, released StarkNet Alpha which allows developers to build dApps on the L2. While the Alpha version currently only supports smart contract deployment and testing, transferring of funds will be available this week. However, the use cases that would reach masses will not come that fast as the Alpha version will more than likely undergo changes and improvements first.

Starknet features

- Account Contracts and Token Contracts — opening the way for DeFi applications to interact with StarkNet in the way they are familiar with.

- Improved Contract Functionality — supporting contract upgradability and events.

- Easier transition from Solidity smart contracts to StarkNet smart contracts.

- Easier integration with existing wallets.

- StarkNet Full Node which will allow users to participate in the network with hardware requirements on par with those of an Ethereum Full Node

zkSync 2.0 is an zkEVM-compatible ZK-Rollup being built by Matter Labs. zkEVM is a virtual machine that executes smart contracts in a way that is compatible with zero-knowledge-proof computation. The first version zkSync 1.0 has been live for 1.5 years and helped reduce Eth transfers by approximately 50x and secured over 4M transactions. zkSync 2.0 has more features, lower costs, and is more compatible and convenient than the previous version.

The difference between zkSync and Starknet is that ZkSync is building an open protocol with decentralization in mind. Matterlabs team’s primary target audience is people using blockchain for financial sovereignty, and 2) decentralized protocols constructed for those people.

StarkWare, on the other hand, is building solutions that are optimized for the performance and defense capabilities of its IP, but with enterprise-level support and SLAs. They are moving to remain indispensable as a technology and service provider. Although a representative of Matter Labs gives the above-given comparison, it is biased to some extent.

How to get exposure to the StarkNet or zkSync?

The Starknet Alpha will start with no transaction fees. Only a few weeks away, the next upgrade will introduce a fee mechanism. It looks like a token will also come, and if the team will offer an investment opportunity, it’s worth keeping your eyes open. In the past few months, the Starkware has seen amazing growth and activity. 20k new followers joined Starkware on Twitter. The discord channel is also growing fast.

Starware already has products like Dydx, Immutable, Sorare, TikTok in their ecosystem, and with the new people (and developers) joining the community, the ecosystem will likely keep growing. The demand for solutions addressing Ethereum scalability and high gas fees is apparent.

Currently, efforts and focus have been dedicated so far to developing zkSync and its security. The zkSync ecosystem includes Loopring, AAVE, Curve, 1Inch, Balancer, Coinbase, Binance, and other projects, and the Twitter page @zksync has grown by 40K new followers in the recent 30 days. The project will also have a native token, but the details are not clear yet. The team suggests following updates on their social channels, although right now, it’s clear that the token will be used for staking and securing the network.

Explanation of LRC/GME Integration

Loopring is also an L-2, but it uses more sophisticated tech called ZK-Rollups.

ZK-Rollups have near instant withdrawals and are even more scalable for info. The good news is that the more usage ZK-Rollups get, the cheaper they become. As we see more usage of Loopring, we will also see fees go down, not up. (Until we hit a much higher bottleneck than the current scale we are at.)

As of now, LRC is working to solve LR2 fragmentation -> Loopring's Ethport will help cross layer-2s in an extraordinarily cheap & capital efficient manner enabling users to move to different L2s at a much lower cost than right now. Further, Ethport will make it much easier for centralized exchanges to withdraw directly to layer2.

Shared Liquidity further reduces fragmentation -> Loopring is in collaboration with other ZK-Rollups to create what they call a dAMM - A dAMM is a shared liquidity AMM that will reduce the liquidity fragmentation that is currently happening on Layer-2's. This means multiple layer-2s can draw from the same pool of liquidity, which removes a lot of market inefficiency.

Current smart wallets, including Loopring's, are expensive to deploy. Loopring's solution is counterfactual wallets. This allows users to use a lot of the benefits of smart wallets without actually having to deploy one and pay the fees for creation. When you want to buy, you will be able to create your smart wallet on an L2, which will considerably lower the fees, but you can always keep using your counterfactual wallet.

The fiat to Loopring onramp -> Loopring has confirmed there will be a fiat to layer-2 onramp that will allow users to be onboard to Loopring without having ever to touch Ethereum with its insane fees. This is huge news because there are currently very limited options for onboarding to layer-2s without having to pay gas fees to the point of being practically non-existent.

Smart wallets -> these are superior to current wallets because you can recover your funds even if you lose your keys. Key management is a thing of the past. Smart wallets let you assign guardians to your wallet. These guardians can be trusted friends, family, or even Loopring, and they can enable you to recover your funds if you lose your keys. A very crucial development in this space.

Negatives -> ZK-Rollups are limited in the type of applications you can build. For most of the activity in crypto, such as sending money, trading, or buying NFTs, current ZK-Rollups work just fine. However, for more complex applications, ZK-Rollups are not generalizable for complex applications. Luckily, Loopring is working on the ZK-EVM to fix this. This will enable any decentralized application to be built on top of Loopring.

The GME-Gamestop partnership has been all but confirmed. Gamestop will be a valuable partner in helping to onboard it is millions of customers to Loopring. Loopring will likely act as the marketplace for Gamestop NFTs. Gaming NFTs will be disruptive tech in the sector and are just starting to heat up. It could be a massive boom in gaming. NFTs and the first company to capitalize on this will set themselves up to be a dominant players in the future of gaming. Multiple sources on 4Chan and Reddit confirm the sighting on this, but not yet been officially announced.

Lastly - Loopring uses a data structure called a Merkle Tree. It's like an off-chain database where your assets are recorded and represented off the chain. However, you can still trade and make transfers on Ethereum without paying gas fees, as it all happens off the chain. Once the individual is ready, he chooses to swap, and the transaction is executed instantly, with no gas fee or delay - L2 balance updated. (basically, no gas fees to change, add liquidity, and trade).

This is their medium link -> Loopring Protocol explained; This is their link to whitepaper -> Whitepaper; Market Cap is only 1.7B, but was 3X less just a week ago, 2B in volumes as of today. Socials -> 13K Discord, 25K Reddit, 100K Twitter - new posts per avg. of every 8 minutes, plus, need to factor in that it is closely related to GME (hence why the stock of GME exploded today as well). Trends are currently at an all-time high these past days, but they also have seen a surge down in August. The current positive/negative tweet ratio is 570 to 70, and overall, more than 3K tweets are done per week with LRC.