Day after day, new projects and images are getting minted - it is getting increasingly challenging to choose on which chain a team should launch a project and on which chain investors should buy the NFTs. Additionally, the extensions and utilities of NFTs are becoming more and more prominent. We strongly believe that the general public will use these assets more efficiently and creatively than they are now in the future.

The markets are looking at Solana, Ethereum, and Polygon chains as the most popular selections for minting and buying. Given that the network of Solana often faces downturn issues, investors and developers are looking for the best alternative ways - this is where the discussions between Ethereum vs Polygon begin.

Ethereum vs Polygon - what are the key differences?

Non-fungible tokens (NFTs) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency. This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can serve as a medium for commercial transactions. It is essential to choose the best suitable chain for sustainable and efficient operations.

A few key things make Ethereum and Polygon stand out when using them for NFTs.

First, Ethereum has a well-established network with a large user base, essential for ensuring security and stability. Polygon also has a strong network, with features that make it more user-friendly than Ethereum. For example, Polygon allows users to set up their nodes and has an easy-to-use interface. This makes it simpler for people to use and helps keep the network running smoothly.

Additionally, Ethereum charges transaction fees, while Polygon does not. This makes Ethereum less cost-effective for users who want to make transactions frequently.

Finally, Ethereum is slower than Polygon when processing transactions. This can be an issue for businesses that need to move quickly and efficiently - this would be the shortened version of our report.

Gas Fees - which one has the edge?

Polygon (formerly known as Matic) has a clear advantage in this sphere. In order to mint NFTs, you basically have to pay nothing. In fact, there are no gas fees on OpenSea for using Polygon. The only way where an investor or a trader needs to pay a small amount is when bridging ETH over to Polygon, but it is still not that costly.

Meanwhile, Ethereum has insane gas fees that are not going to be solved until 2.0 Protocol arrives to the ecosystem. Currently, fees incur for auction offers, transfers, buying, selling, canceling bids - all of this range anywhere from 30 to 300 USD.

In addition to this - the transactions are not only cheaper, but faster as well. Polygon takes around 5 seconds or less to complete the action, while Ethereum forces users to sometimes even wait more than 1 minute before finalization.

To add salt to the wound and criticize Ethereum even more, Polygon is arguably slightly more scalable. It is capable of more than 10 000 TX/S per sidechain.

GameFi and OpenSea

Initially, the Ethereum team tried to implement a side chain scaling. Polygon, formerly Matic, actually realized that solution with its protocol. Polygon also works as a partner network to Ethereum rather than a competitor. It is even though some games choose to migrate to the new chain.

Polygon and Ethereum are some of the busiest networks for NFT trading and play-to-earn games. Ethereum was the first network to host collectibles and games, and Polygon arose out of a need to have faster, cheaper transactions and scale Ethereum.

Not that long ago, the OpenSea platform added support for Polygon NFTs as well as Ethereum NFTs. Polygon NFTs were added because the cost to swap on Ethereum became too expensive for everyday investors, and they needed an alternative.

And although Polygon is a cheaper alternative, the NFTs available on their network are significantly worse and have little cultural significance. The main popular NFTS like Cryptopunks, Bored Ape Yacht Club, Azuki’s, and Pudgy Penguins live on Ethereum and are not available on secondary chains like Polygon.

Because the cost to transact on Ethereum is so high, the gaming sector has completely moved away from the ETH blockchain. We have seen popular GameFi games like CryptoRaiders and CryptoUnicorns move natively to the Polygon blockchain thanks to the sub-1-cent fees and fast finality. This ultimately means that if you are looking to play blockchain games, Polygon is your best bet here again.

The problem with ETH 2.0 and what it means for Polygon

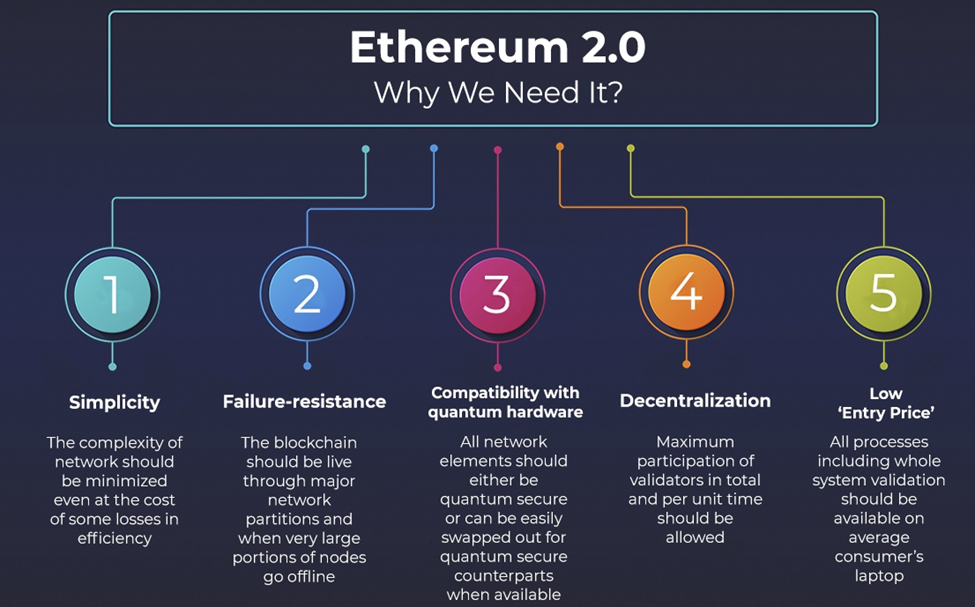

As the world is waiting for the new merge of Ethereum to appear, not everyone realizes what impact it will have on the markets. Additionally, there is not a lot of information out there about the new compatibility that will take place.

First of all, ETH 2.0 will use scalable shards and ZK-Rollups to finalize everything into a beacon chain periodically. Shards, in this situation, mean a minor version of a network, where a transaction is synchronized from that minor version to the original-main network. After sharding is completed and decentralization is secured, the fees will drop 32-64 times, depending on the number of shards. Once the price of ETH goes up, so will the number of shards.

Polygon, meanwhile, is the original Ethereum network with a proof-of-stake that allows the cap fee not to blow up significantly. It also has a lower block time and conducts more transactions than Ethereum. However, Polygon WILL NOT scale with ETH 2.0 as it cannot handle more transactions after it rolls up to ETH 2.0 because the network of Polygon does not off-load transaction executions to Ethereum. Additionally, the fees are not expected to go lower with ETH 2.0.

This means that after the conversion is done, it is highly likely for ETH 2.0 to smoke Polygon wholly and overtake the industry. But will this continue to be the trend in the future? Probably not. For now, Polygon enables actual on-chain creativity and better performance, while ETH art is mostly just a URL or a JPG.

Conclusion

If you launch an NFT collection to a very huge and different audience, target Ethereum as the best option on OpenSea. However, if most of the audience is experienced within the NFT circle, NFTs on Polygon would serve better on the OpenSea. Ethereum is way more popular across the consumer and it builds more hype around the project.

Ethereum has more emphasis on features and improvements, rarely goes through any issue and is very stable, efficient, and secure. Its architecture is more stateful and is better for application development. It also needs a lot of processing power and has a high requirement of resources - has less transaction speed.

Polygon, on the other hand, has a decent validation system. It is built to scale with the increasing volume of transactions and provides a very similar experience to that of Ethereum. Minting on websites such as OpenSea is cheaper. Selling or auctioning your NFT through Polygon is also absolutely free. However, after the developments of ETH 2.0, Polygon might not be required as the second layer solution.

If you prefer security, prestige and price - choose Ethereum. If you prefer a more casual approach, more GameFi and no gas fees for the audience - choose Polygon.

Liked our post? Check out our previous review of the Solana network here!