Last week, we discussed the halving of Blur's airdrop rewards points from May 1st and the potential implications for NFTs unless something new emerges to spark market activity.

Coincidentally, Blur, a non-fungible token (NFT) marketplace, announced and launched Blend on the same day the rewards were halved. This peer-to-peer lending platform could potentially boost liquidity for NFTs.

1/ Blur Lending, aka Blend, is NOW LIVE.

— Blur (@blur_io) May 1, 2023

If you have a Punk, you can now borrow up to 42 ETH within seconds.

If you want an Azuki, you can now buy one with just 2 ETH up front.

Points have been updated as well. Learn more 👇 pic.twitter.com/jRBwE8DYEo

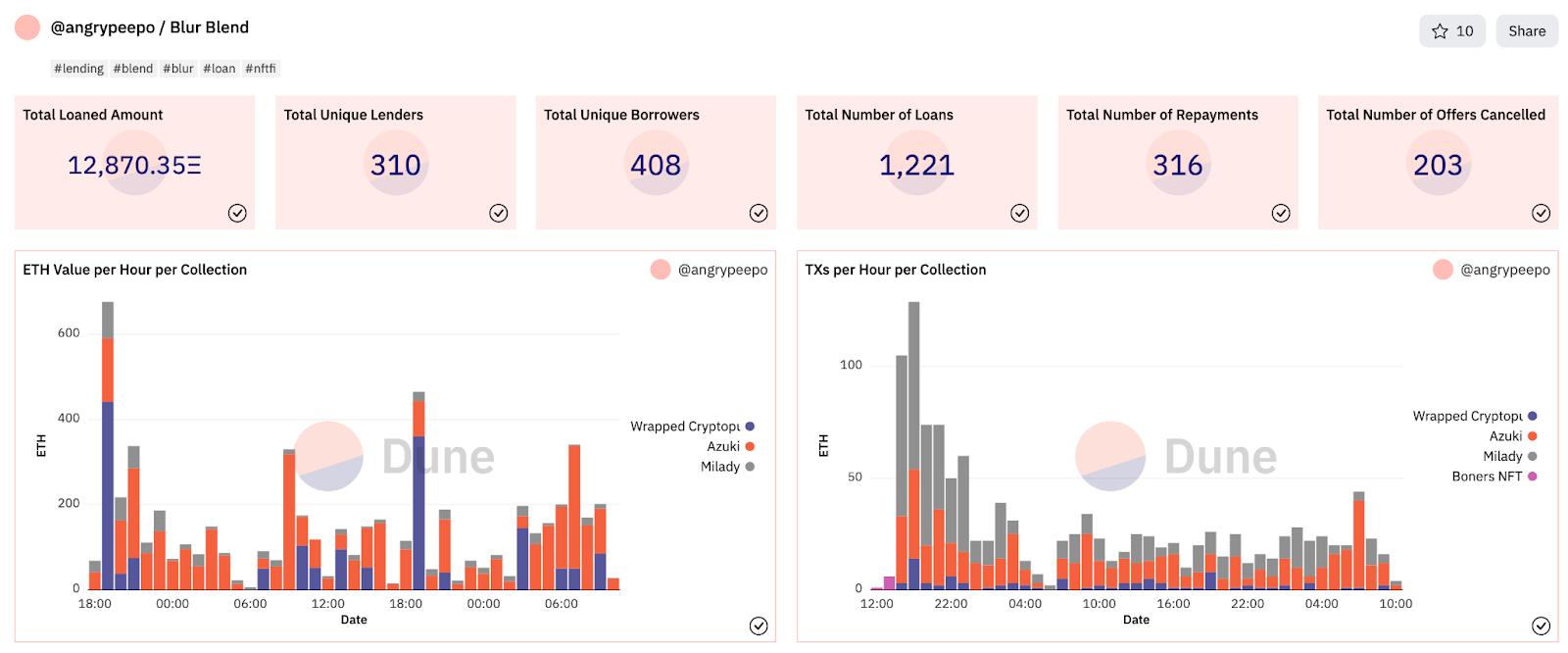

Blend launched with three collections: CryptoPunks, Azuki, and Milady. More projects will be added in the future. Despite the limited choices, within the first days of its launch, the Blend platform already attracted 310 unique lenders, 408 borrowers, and 1,221 total loans.

Let's dive deeper into Blend! How does it compare to other NFT lending protocols, and what benefits or disadvantages does it have over them?

Types of NFT Lending Protocols

In simple terms, NFT lending protocols enable you to take a loan using your NFTs as collateral. This is not a new phenomenon, and there are dozens of dApps offering such services, although they may differ from one another. It is crucial to understand these differences before using any of these lending platforms.

Peer-to-Peer Model

There are two main types of lending protocols that have gained traction over the past year. One of these protocols is peer-to-peer lending, where borrowers list NFTs they want to use as collateral. They can then place an offer specifying the amount, duration, and the rate (APR) they are willing to lend for. As the name suggests, the arrangement occurs between two parties – on one end is an NFT owner who wants to borrow against their NFT, and on the other side is someone who wishes to earn interest by lending cryptocurrency. A lender might also receive a collateralized NFT if a loan is defaulted. Some lenders might use this strategy to acquire NFTs at a significant discount.

The main benefit of the peer-to-peer model is that there are no automatic liquidations before the loan expiration date. However, interest rates may be higher due to the absence of liquidation if the NFT floor price drops below the loan amount. Additionally, lower loan-to-value ratios can make loan terms less attractive for borrowers (Loan-to-value is calculated simply by taking the loan amount and dividing it by the value of the asset or collateral being borrowed against).

Peer-to-Pool Model

In the peer-to-pool model, lenders deposit their ETH into a pool that earns a variable APR, while borrowers deposit NFTs and borrow at around 40-60% LTV .

A significant difference between the peer-to-pool and peer-to-peer models is that the peer-to-pool model has no repayment deadline. This offers borrowers flexibility and less risk. However, the protocol sets a health factor, determining the conditions under which the NFT collateral may be liquidated before the loan's duration ends.

Lenders are allowed to deposit and withdraw funds from the liquidity pool at any time without lockups. Unlike in the peer-to-peer model, the yield is not fixed and will fluctuate with the demand for lending.

However, the peer-to-pool model has some potential downsides. The risk of collateral liquidation if the health factor conditions are met may deter some users, and the model may not be suitable for NFTs with fluctuating floor prices, as it could lead to premature liquidations.

Blend vs. Sharky

How To Lend And Borrow On Sharky?

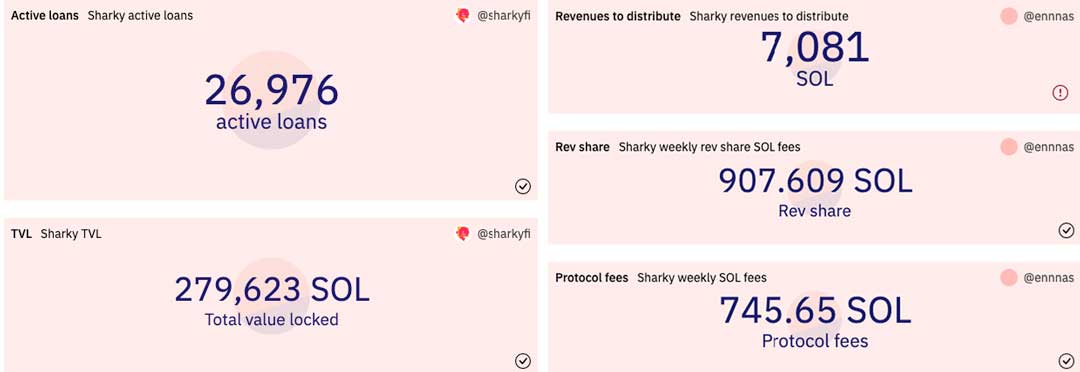

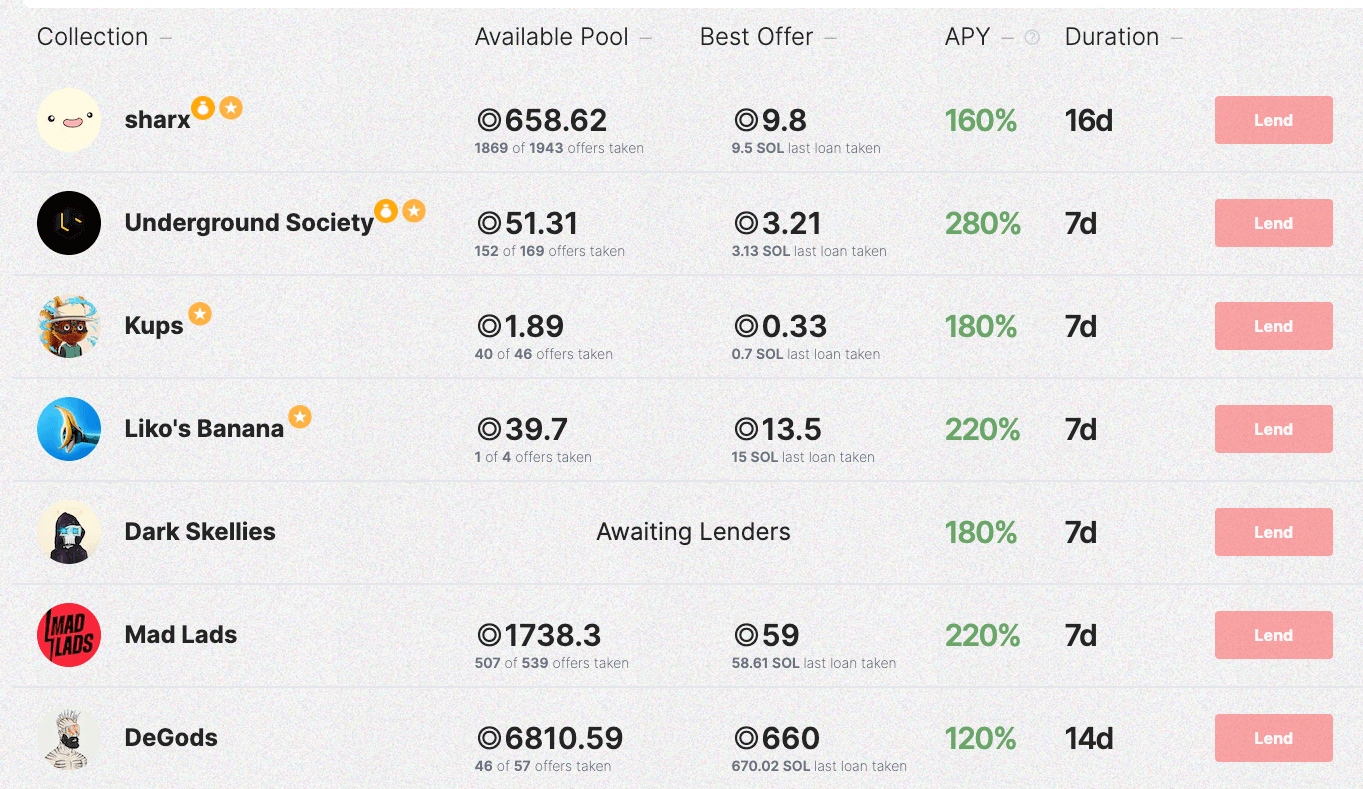

If you are familiar with Solana NFTs, there's a chance you have heard of Sharky (or Sharky.fi) – the largest NFT lending protocol on Solana. The platform currently has nearly 27 thousand active loans and 280 thousand TVL in SOL (6 million in USD). Let's compare Sharky with Blend, as the platform serves as a great example of peer-to-peer NFT lending.

The platform allows borrowers to get cash on-demand by selecting the NFT they want to use as collateral. Interest is fixed per loan, and borrowers can pay back the loan early at any time. However, repayment must be made in a single payment, not partially. If a loan defaults, the lender can foreclose on the NFT collateral. However, the borrower still has an opportunity to repay the loan for a specified amount of time, as long as the lender has not foreclosed.

As a lender, you can browse over 100 available SOL NFT collections and propose a loan amount. If your offer is currently the best, it will be taken by the next borrower. This means that an offer will not be accepted instantly; the better the offer, the more quickly it will be accepted. Once confirmed, most loans have a duration of 7 to 14 days.

The APY on the platform might entice you to lend all the SOL in your wallet or even buy some more to lend. However, the interest is calculated annually, and you would get the return based on the loan duration.

Lending And Borrowing On Blend

The Blend platform is unique, as it doesn't fit into either the peer-to-peer or peer-to-pool model. The platform offers a novel approach to NFT lending that combines the benefits of existing protocols and can be advantageous for both lenders and borrowers. To be more specific, Blend can be referred to as a peer-to-peer perpetual lending protocol.

Unlike Sharky, where a borrower has a set duration for repayment, Blend's borrowings keep accruing interest without an explicit repayment timeline.

Blend's model allows for customization of terms and LTV, where higher LTV means higher risk but higher yield. The protocol is also unique in that it has no collateralization ratio and no Oracle system, which means it doesn't suffer from the same Oracle-based attacks that most traditional lending protocols experience.

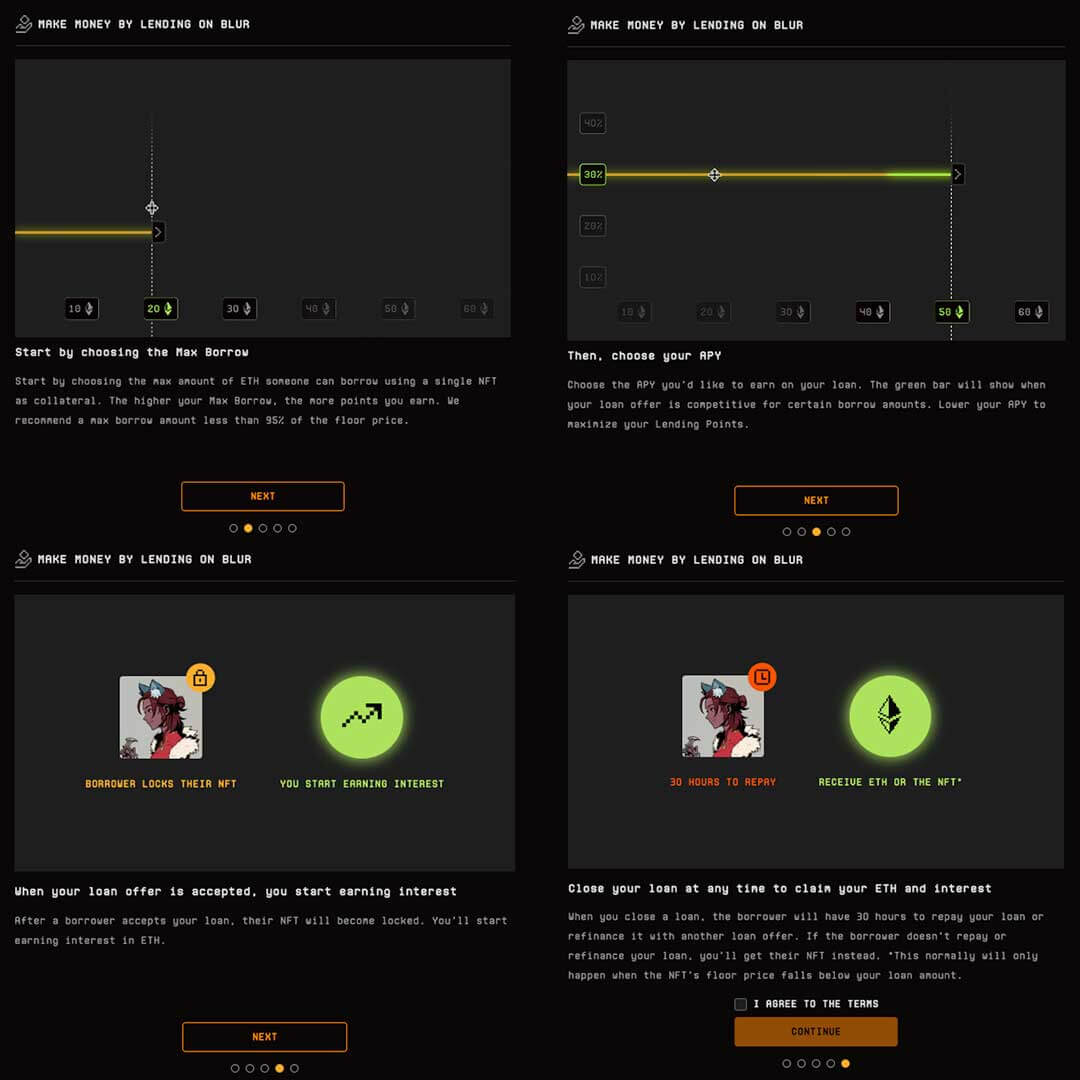

For lenders, the process begins by connecting their wallets and funding them with the necessary assets. They choose the maximum amount to lend and set their desired annual percentage yield (APY). After a borrower accepts the loan, the lender can close it at any time and claim the interest accrued. If the lender requests repayment, the borrower has 30 hours to pay back the loan, during which their loan's interest rate increases rapidly and might go up to 1000%. This innovation makes Blend one of a kind, as other lenders can buy the loan from the previous lender. The higher the interest, the more attractive the loan is in terms of investment. Rising interest also urges the borrower to repay as soon as possible.

If the borrower fails to repay the loan and no other lender is interested in buying it out, the lender will receive the collateralized NFT 30 hours after the auction is triggered. If it reaches this point, it is likely that liquidating the NFT will not cover the balance of the loan.

Unlocking NFT Liquidity

NFT lending is an emerging trend that's gaining traction in the crypto world. Loaning an NFT allows users to diversify their portfolios and maximize the potential of their digital investments.

An NFT loan can be a win-win for both lenders and borrowers. Borrowers can use their relatively illiquid NFTs in exchange for crypto funds, while lenders can earn interest on the NFT without actually owning it.

Blend's peer-to-peer perpetual lending protocol introduces a unique approach that offers more flexible strategies to both lenders and borrowers. Its customizable terms, absence of a collateralization ratio, and Oracle system make it a distinctive addition to the DeFi ecosystem. It remains to be seen if Blend will impact the overall ETH NFT market by injecting more liquidity into it, but it's clear that Blend is heading in the right direction.